A2 Gold Corp. (TSXV: AUAU, OTCQX: AUXXF) – formerly Allegiant Gold – has officially rebranded and is stepping into a new phase of aggressive exploration across Nevada’s prolific gold belt.

With over 1.4 million ounces of inferred gold already outlined at its flagship Eastside Project, and new core drilling now underway, A2 Gold is emerging as one of the most promising exploration stories in the western U.S.

Why Investors Are Paying Attention

- Fresh Identity, Renewed Focus: The rebrand marks A2 Gold’s strategic shift toward discovery-driven growth and market visibility.

- Expanding Drill Campaigns: New core drilling programs are now testing multiple high-priority zones, including McIntosh and Castle.

- Infrastructure Advantage: Located near Tonopah, Nevada – with access to water, power, and logistics – Eastside offers cost-efficient development potential.

- Strong Backing: The company previously raised $10.5M in financing with strategic investor support, including Kinross Gold participation.

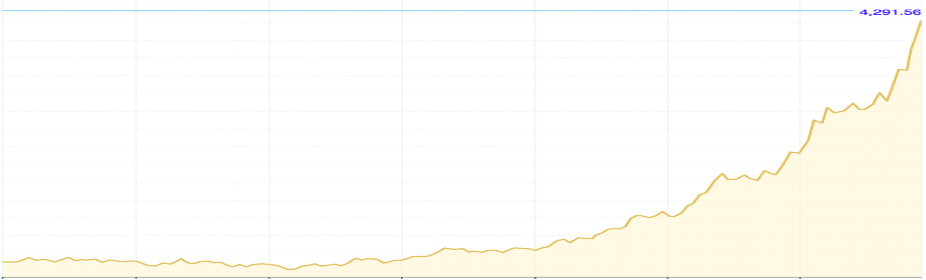

- Gold Market Tailwind: With spot prices near all-time highs (~US$4,000/oz) and central banks signaling easing cycles, investor appetite for gold explorers is strong.

Eastside Project Snapshot

- Location: Tonopah, Nevada – one of North America’s top gold mining jurisdictions.

- Resource: 1.4Moz Au + 8.8Moz Ag (Inferred)

- Drilling: Active core program under way (Q4 2025)

- Goal: Expand the resource base and confirm higher-grade zones through systematic drilling and geophysics.

Upcoming Catalysts to Watch

- Q4–Q1 drill results from Eastside core program

- Expansion plans for McIntosh and Castle zones

- Ongoing metallurgical studies and resource update in 2026

- Investor and conference engagements across North America

Gold Market Perspective

Gold has recently surged past US$4,000/oz, driven by renewed central bank buying, monetary easing, and growing economic uncertainty. The Bank of Canada’s September 2025 rate cut to 2.50% and U.S. Federal Reserve’s continued dovish stance have further strengthened demand for hard assets.

This bullish environment provides strong tailwinds for explorers like A2 Gold. With inflation concerns persisting and institutional interest returning to the sector, companies with large, expandable resources in low-risk jurisdictions like Nevada are drawing renewed investor attention.

Why A2 Gold Now

Gold prices are breaking records. Exploration sentiment is turning bullish. And A2 Gold’s Nevada assets give investors exposure to a low-risk jurisdiction with high-grade upside.

With a refreshed brand, strong balance sheet, and drilling momentum, A2 Gold is positioned to capture renewed investor attention in 2025 and beyond.

Learn More & Stay Connected

Visit www.a2gold.com for the latest corporate presentation, drill maps, and news updates.

Follow A2 Gold on LinkedIn | Twitter

Marc has been involved in the Stock Market Media Industry for the last +5 years. After obtaining a college degree in engineering in France, he moved to Canada, where he created Money,eh?, a personal finance website.