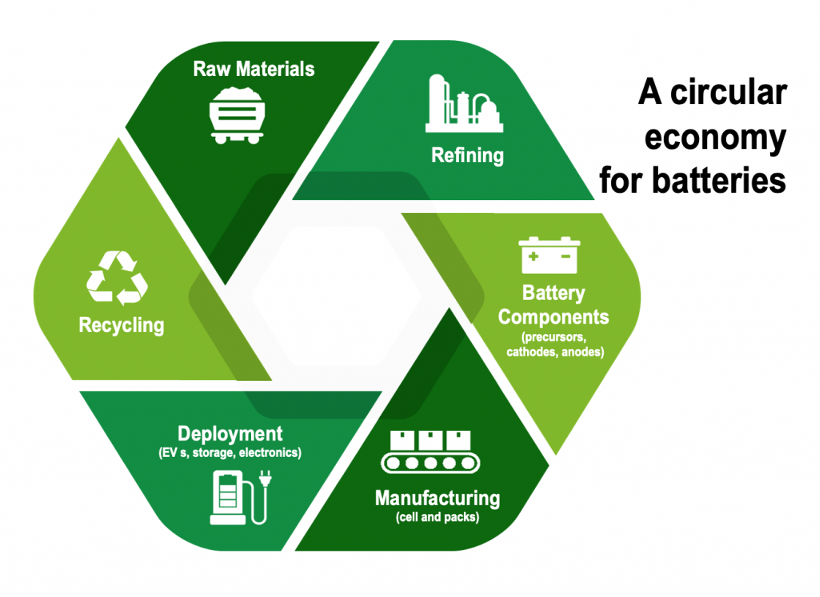

St-Georges Eco-Mining Corp (CSE: SX) (OTCQB: SXOOF) (FSE:85G1) St-Georges develops new technologies to solve some of the most common environmental problems in the mining sector, including maximizing metal recovery and full-circle battery recycling. The Company explores nickel and PGEs on the Manicouagan and Julie Projects on Quebec’s North Shore and has multiple exploration projects in Iceland, including Thor Gold.

Salient Growth Numbers for SX’s Main Businesses;

- GLOBE NEWSWIRE) — The Global Waste Recycling Services Market Size is to grow from USD 61.76 billion in 2022 to USD 107.51 billion by 2032 at a Compound Annual Growth Rate (CAGR) of 5.7% during the forecast period.

- Green Mining Market (Eco-mining) is expected to grow from USD 11.0 billion in 2022 to USD 17.6 billion by 2027 at a CAGR of 9.9% during the forecast period.

Two Recent developments make SX—already an attractive mining/recycling venture—even more compelling.

- As SX awaits environmental authorization, it is rapidly moving toward fully implementing the Company’s battery recycling facility in Thorold, Ontario.

“Planned visits from prospective providers and buyers have begun. The Company expects that employees from the battery circuit manufacturers will start arriving in Thorold in October. They will assist with the setup and the initial operation of the 7,920 ton/year multi-chemistry capacity circuit.” (PRAug 30)

- The Company has arranged for a $1,250,000 private placement offering in units. Up to 12,500,000 units priced at $0.10 are expected to be issued. Each unit will consist of one hard cash common shares of the Company and one hard cash warrant priced at $0.15, which expires 24 months after issuance. Insiders’ participation is expected to be significant.

The most significant percentage of proceeds will be used to complete and operate the Thorold facility above and further minor amounts for necessary administrative issues.

NEXT?

Building quickly to process batteries for recycling, SX is also looking to transfer its tech and collaborate with its Italian partners to take advantage of the giant South European market.

Later this year, SX will report on a similar deal with a significant South Asian market initiative.

Profitability is highly dependent on several factors. The most important is cell chemistry: the value of the recovered materials. The value of NCM and NCA batteries can exceed $25 per kilowatt-hour. In contrast, the metals in a lithium-iron-phosphate (LFP) battery are worth only half of those used in NCM batteries. The value of nickel, in particular, will determine the attractiveness of the business case in the coming years as manufacturers shift to batteries with a higher nickel content. Bcg.com

- The lithium-ion battery segment accounted for 46% of revenue share in 2022.

- The lead-acid battery segment had a significant market share of over 30% in 2022.

- By application, electric cars held a 39% market share in 2022.

- In 2022, Asia Pacific had a market share of over 51%.

Factors such as rising demand for zero-emission vehicles, a tightening supply of specific battery pack components, and increased use of recycled products will likely boost the

electric vehicle battery recycling market. Furthermore, increasing uniformity in the legislative environment for electric vehicles in emerging nations would propel the electric vehicle battery recycling industry forward. (precedenceresearch.com)

Bottom Line.

There needs to be more debate about the efficacy of SX’s mining operations, as this small tome purports. As with any recycling endeavour, success depends on corporate infrastructure, management, and supply of materials. SX looks to have all three in abundance.

The Company doesn’t take chances but approaches business growth by taking advantage of mining and recycling problems that need serious attention.

SX’s circular approach and the importance of announcing the progression to opening the Thorold facility and spreading its technology throughout the Globe.

As I have said, we all wish to support companies that. Shape the future for ourselves and the planet’s betterment.

You just did. Have a good look at SX.

Bob Beaty

For over 30 years, Bob Beaty has been explaining concepts and companies to the global investment community. One of the original writers for Jim Cramer’s Thestreet.com, he also wrote for AOL (Can/US), the Globe and Mail, and the Huffington Post. Over that period, he illuminated small-cap companies to investors with wit and pith but mostly opinion and facts. Investing should be fun. Pedantic, staid content is no fun.

Before embarking on his writing career, Bob had a successful international journey in the finance industry. He served as a broker, derivatives product manager, and a Director of London's Credit Suisse subsidiary. His career spanned across major financial hubs including Toronto, Vancouver, and the UK, giving him a unique global perspective. (He is still fondly remembering those English client lunches.)

Other than everything Groucho Marx and George Carlin ever said, Bob lives by a simple credo;

‘Never do anything the person standing in front of you can't understand.’ Hunter S. Thompson.

Let’s go.