- Amidst challenges like inflation and interest rate hikes in various sectors, the oil and gas industry has consistently proven to be a safe and reliable investment choice.

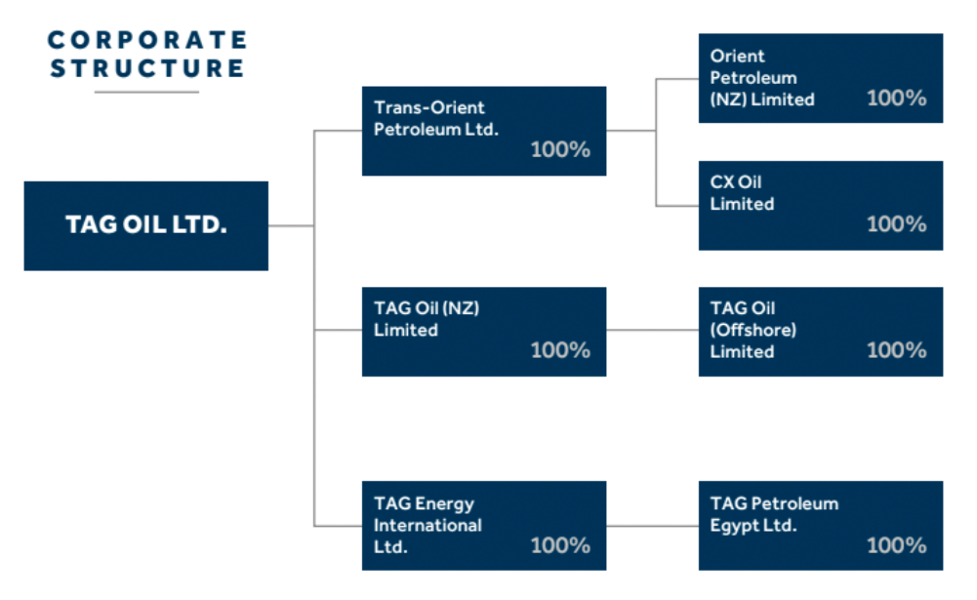

- TAG Oil is a Canadian-based and publicly listed oil and gas exploration company specializing in acquisitions, exploration, and production in the Middle East and North African (MENA) region.

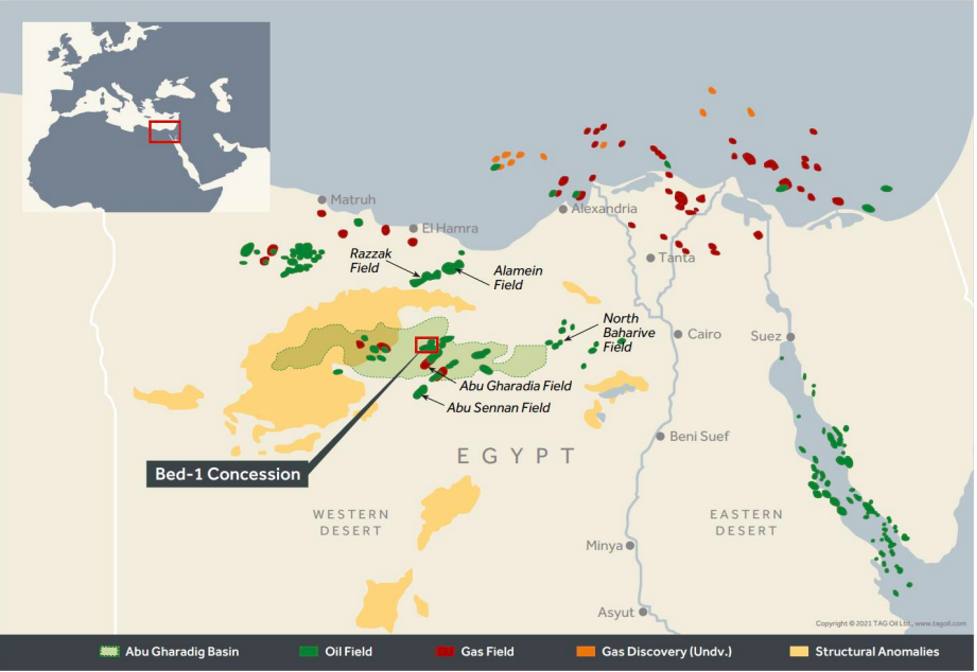

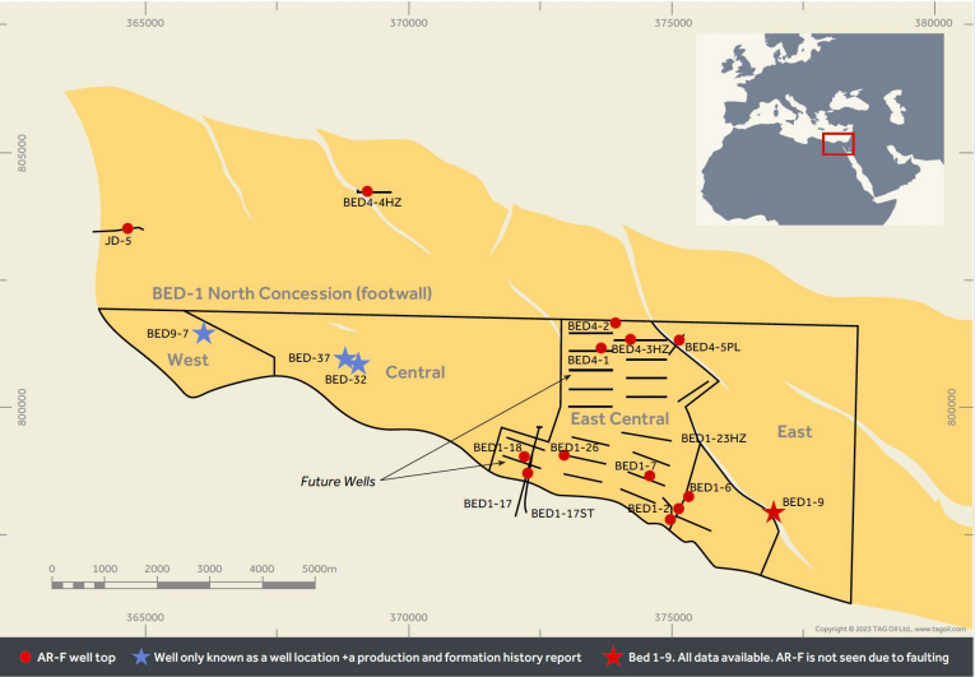

- TAG Oil is actively involved in developing the unconventional heavy oil Abu Roash “F” (ARF) formation within the Badr oil field (BED-1) in the Western Desert of Egypt. Reserves evaluations indicate significant resource potential, with estimates exceeding 500 million barrels of oil in place in the ARF target.

While many sectors suffer from key factors such as inflation, interest hikes, the Oil & Gas sector has been consistently performing and revealed to be a safe investment place for investors. And in the sea of promising stands out Tag Oil (TSXV: TAO, OTCQX: TAOIF), a company focused on exploring the Middle East and North African region. The company’s continuous growth started off right after the 2008 financial crisis, and since then, Tag Oil has demonstrated constant significant landmarks.

The Oil & Gas industry Has Always Been A Safe Sector For Investing

In 2022, the oil and gas (O&G) industry achieved unprecedented levels of profitability, endowing them with substantial financial resources to execute their strategic plans in 2023. Even amid the backdrop of geopolitical and macroeconomic volatility, O&G enterprises have received a resolute directive: to ensure short-term supply security while embarking on a steadfast journey towards cleaner energy solutions in the long term.

Through the rigorous adherence to prudent capital management, with a keen emphasis on cash flow generation and payouts, the global upstream sector is poised to achieve an unprecedented milestone. By the close of 2022, it is anticipated to yield an all-time high of $1.4 trillion in free cash flows, based on the assumption of an annual Brent oil price averaging $106 per barrel. The spotlight now shifts to upstream corporations as the world eagerly observes whether they will persist in prioritizing shareholder distributions or opt to bolster their reinvestment in hydrocarbon endeavors, driven by the pressing imperative to deliver affordable energy to the global populace.

The confluence of favorable policies and augmented cash flows within the oil and gas (O&G) sector during 2022 has empowered O&G firms to escalate their commitments to clean energy initiatives. While this upward trajectory in clean energy investments is anticipated to persist, it is essential to recognize that various factors may exert influence on the pace and direction of these investments.

Tag Oil Owns Strong Assets

TAG Oil (TSXV: TAO, OTCQX: TAOIF) is a Canadian-based and publicly listed oil and gas exploration company that focuses on acquisitions, exploration, and production activities within the Middle East and North African (MENA) region.

Their forward-looking strategy involves positioning the Company for substantial growth through strategic acquisitions, property development, enhanced production methods, and seizing overlooked opportunities. The leadership team at TAG Oil has a track record of successfully implementing these strategies in the past, and they are committed to creating new and significant value for shareholders in the future.

While TAG Oil is in the process of finalizing its new strategic acquisition plan in the MENA region, the company continues to receive production royalties in New Zealand and maintains a strong balance sheet.

In the Western Desert of Egypt, TAG Oil is actively involved in the development of the unconventional heavy oil Abu Roash “F” (ARF) formation within the Badr oil field (BED-1). According to the reserves evaluation conducted by RPS Energy, the ARF target in BED-1 is believed to hold a substantial resource potential, with estimates exceeding 500 million barrels of oil in place. Moreover, there is a high degree of confidence in the feasibility of achieving successful commercial development in this reservoir.

TAG Oil intends to leverage its extensive expertise in Enhanced Oil Recovery (EOR) techniques, which have a proven track record in Canada over many years. They plan to apply these techniques to address the challenges posed by the low porosity and permeability of the ARF reservoir in Egypt, ultimately unlocking its considerable potential.

BED-1 Is Key To Further Expansion

The BED-1 concession was formerly under the ownership of Shell, and it yielded over 90 million barrels of light oil from formations situated beneath the ARF. In 2012, Shell relinquished control of BED-1, and since then, the field has been operated by BPCO, a wholly owned subsidiary of EGPC.

Current Production:

Presently, BED-1 is producing approximately 5,000 barrels of oil per day (bopd) from the deeper zones within the field. Additionally, the field is equipped with a processing facility capable of handling up to 25,000 barrels of oil.

Concession Term:

The concession for BED-1 is in effect until 2032, with the option of a 10-year extension, extending the term to 2042.

Service Fee:

BPCO has committed to paying TAG Oil a service fee, calculated as a percentage of the gross Production Revenue Entitlement. This fee is intended to compensate TAG Oil for assuming 100% of the capital and operating expenditures. The fee structure is as follows:

- If production levels reach up to 10,000 bopd and the Brent Oil price falls within the range of $70 to $90, the fee amounts to 62% of production revenue. Taxes and royalties are to be borne by BPCO.

Project Phases:

The development of BED-1 is divided into two phases:

- Phase 1: This is the Evaluation Period, regarded as a pilot development stage, requiring a commitment of $6 million.

- Phase 2: Following a successful evaluation period, the project enters the Commercial Development stage, which also entails a $6 million commitment.

TAG Oil has achieved a significant milestone by successfully drilling a vertical pilot hole to a depth of 3,290 meters. Following this accomplishment, the company conducted a comprehensive suite of operations, including open-hole logging, formation imaging, and pressure measurements. Subsequently, they executed a cement plug-back procedure for the lower vertical pilot hole, paving the way for the next phase of their operation.

The invaluable data amassed during the T100 well drilling, including insights from mud logging and drill cuttings to assess reservoir quality along the lateral section, will be harmonized with the existing body of work related to geo-mechanical properties and 3D seismic interpretation in the area. This synergy will inform the design of the well completion and fracture stimulation program. Furthermore, the performance insights garnered from the T100 well will serve as a cornerstone for the strategic planning and execution of future drilling initiatives, with the Company set to embark on these endeavors in calendar Q1 2024. TAG Oil remains committed to advancing its operations and delivering exceptional results.

What You Should Remember About Tag Oil (TSXV: TAO, OTCQX: TAOIF)

The ongoing development of the T100 well in the ARF formation represents a pivotal phase in TAG Oil’s journey. As the company gathers critical data, including insights from mud logging, drill cuttings, and geo-mechanical properties, it will inform the design of future well completions and fracture stimulation programs. The performance of the T100 well will serve as a foundation for upcoming drilling initiatives slated for calendar Q1 2024, reinforcing TAG Oil’s commitment to progress and excellence.

In summary, TAG Oil’s consistent growth, strategic focus, and commitment to innovation position it as a compelling player in the dynamic oil and gas sector. As the company continues to advance its operations and deliver exceptional results, it remains a promising investment opportunity in an industry known for its stability and resilience.

Marc has been involved in the Stock Market Media Industry for the last +5 years. After obtaining a college degree in engineering in France, he moved to Canada, where he created Money,eh?, a personal finance website. He then contributed to building Guerilla Capital, a Capital Markets company and FirstPhase Capital where he was head of research. At10xAlerts, he writes articles and conducts interviews on many sectors, including breaking news technology, metals & mining markets.