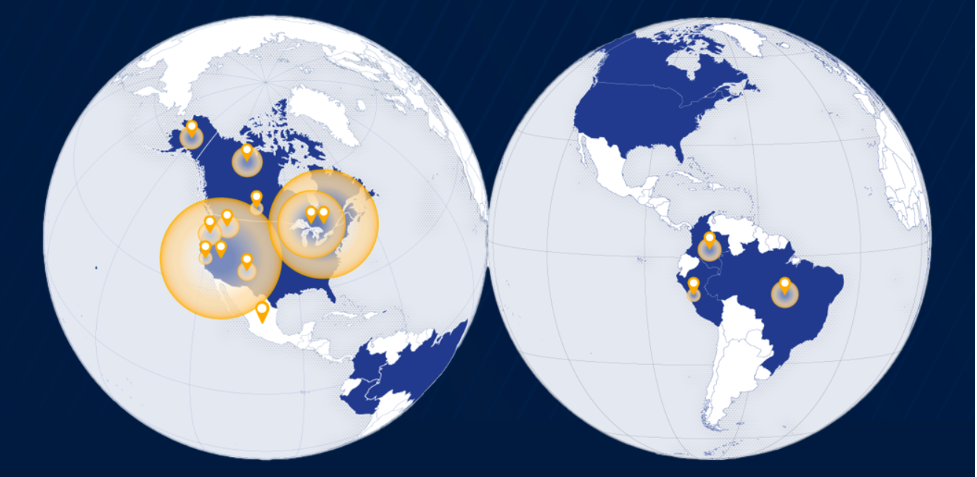

- Innovative Financing Model and Diversified Portfolio: Gold Royalty leverages a unique business model by acquiring royalties and streams, offering upfront capital to mining projects in exchange for a percentage of future production or revenue. The company’s diversified portfolio spans over 200 royalties and streams across geopolitically stable regions, primarily in the Americas, minimizing geographical and operational risks while ensuring a stable and potentially growing revenue stream.

- Strategic Advantages and Experienced Management: The company’s strategic advantages include its diversified portfolio and an experienced management team with a proven track record in the mining industry.

- Financial Health and Positive Outlook: Despite challenges like negative earnings per share, Gold Royalty Corp maintains a solid balance sheet and a commitment to returning value to shareholders, evidenced by a forward dividend yield. The company’s financial strategies are designed to capitalize on market opportunities and navigate the cyclical nature of the mining sector. With a positive revenue and expense trend as of Q3 2023 and expectations to break into positive free cash flow in 2024, Gold Royalty is well-positioned for future growth and success in the precious metals market.

In the dynamic realm of precious metals, Gold Royalty Corp (NYSE: GROY) emerges as a beacon of innovation and strategic growth. As a company specialized in royalty and streaming, Gold Royalty leverages a unique business model to finance mining projects, offering investors exposure to gold and other precious metals without the operational risks associated with mining.

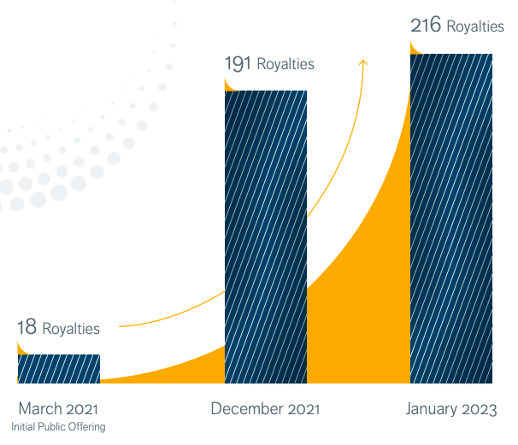

Let’s Take a Deeper Look at Gold Royalty Founded on the principles of value creation and sustainable mining, Gold Royalty (NYSE: GROY) has quickly ascended to prominence within the precious metals sector. With a diversified portfolio of over 200+ royalties and streams, the company focuses on high-quality mining projects in geopolitically stable regions, primarily across the Americas. This expansive portfolio includes interests in various stages of the mine lifecycle, from advanced exploration to early exploration, showcasing a broad spectrum of investment in the precious metals space.

The essence of Gold Royalty’s business lies in its ability to offer creative financing solutions to the mining industry. By acquiring royalties and streams, Gold Royalty provides upfront capital to mining companies for their projects, in exchange for a percentage of future production or revenue. This model not only fuels the development of mining projects but also ensures a non-dilutive, leveraged exposure to precious metals for Gold Royalty and its shareholders.

Strategic Advantages

Gold Royalty Corp’s strategic advantages are multi-faceted and pivotal to its success in the competitive landscape of precious metals royalty and streaming. These advantages are derived from the company’s operational model, market position, and strategic initiatives, which collectively bolster its prospects for growth and resilience in the volatile mining sector.

The diversification of Gold Royalty Corp’s portfolio stands out as a primary strategic advantage. By holding over 200 royalties and streams across mining-friendly jurisdictions in the Americas, the company minimizes geographical and operational risks. This wide-ranging portfolio not only spreads risk but also ensures a stable and potentially growing revenue stream from different stages of mine development, from advanced exploration to early exploration phases.

Canadian Malartic Complex

The Canadian Malartic Complex, highlighted by the Canadian Malartic gold mine and Odyssey Underground Project, stands as a cornerstone of Canada’s gold mining sector, fully owned by Agnico Eagle. This complex showcases significant expansion potential, particularly through the Odyssey project, which is on track to markedly boost Canada’s underground mining capacity with substantial annual gold output projections. The project leverages extensive mineral resources and existing plant capacity to possibly extend its operational life beyond initial forecasts. Gold Royalty Corp holds a valuable 3.0% NSR on key mineralized zones within this project, underpinning its strategic investment footprint.

The Côté Gold Project

The Côté Gold Project, a significant asset in northeastern Ontario, Canada, is under development by IAMGOLD and Sumitomo Metal Mining, with IAMGOLD holding a 64.75% interest. It’s planned as a large-scale open pit operation, aiming to be one of Canada’s largest gold mines with substantial annual gold production. As of late 2022, the project was 73% complete and is slated to start production in early 2024. This development represents a major investment in Canada’s gold mining industry, bolstered by recent financial transactions to support its completion.

REN Project

The REN Project is a high-grade, underground extension of the Goldstrike Mine along Nevada’s prolific Carlin Trend, operated by Barrick Gold Corp within the Nevada Gold Mines joint venture. REN, known for its significant gold potential, is part of a strategic area that has produced over 70 million ounces of gold. Gold Royalty holds a 1.5% NSR and a 3.5% NPI in REN, where ongoing drilling aims to expand its mineral resource estimate, promising to enhance the Carlin complex’s production with high-grade ore.

Financial Health and Outlook

The financial structure of Gold Royalty (NYSE: GROY) is designed to balance growth with financial stability. The company’s use of convertible debentures and strategic investments underscores its savvy approach to capital management, enabling it to fund expansions while maintaining a solid balance sheet. As the precious metals market continues to evolve, Gold Royalty’s financial strategies ensure it remains well-positioned to capitalize on market opportunities and navigate the cyclical nature of the mining sector.

Despite not having a PE Ratio due to negative earnings per share (EPS) of -$0.14, the company maintains a forward dividend & yield of $0.04 (2.67%), indicating a commitment to returning value to shareholders. The stock’s 52-week range has been between $1.18 and $2.48, which suggests volatility but also potential for significant upside.

During the quarter ending June 30, 2023, Gold Royalty Corp engaged in financial activities that included a net cash use of $2.6 million in financing activities. This sum was primarily allocated towards the distribution of shares ($0.4 million), interest payments ($0.3 million), and dividend payments ($2.6 million), revealing the company’s financial maneuvers to sustain its growth trajectory and shareholder returns.

“I am very encouraged by our team’s progress in Q3 2023, having achieved a 48% increase in quarterly Total Revenue and Land Agreement Proceeds* in addition to a 50% decrease in quarterly Cash Operating Expenses* year over year. Our business is currently on track to deliver on our 2023 guidance and poised to break into positive free cash flow in 2024.

David Garofalo, Chairman and CEO

What to Remember About GROY

Gold Royalty (NYSE: GROY) stands out as a strategic, growth-oriented player in the precious metals royalty and streaming space. With a diversified portfolio, experienced management, and innovative financing strategies, the company is poised for continued success. As Gold Royalty expands its portfolio through strategic acquisitions and partnerships, it offers a compelling value proposition for investors seeking exposure to precious metals without the operational risks of mining.

Investors and stakeholders in Gold Royalty Corp can look forward to a future marked by strategic growth, financial resilience, and a commitment to generating sustainable returns. As the company advances its mission to build a balanced portfolio of royalty and streaming assets, it solidifies its role as a key financier in the precious metals sector, promising an exciting journey ahead for all involved.

Marc has been involved in the Stock Market Media Industry for the last +5 years. After obtaining a college degree in engineering in France, he moved to Canada, where he created Money,eh?, a personal finance website. He then contributed to building Guerilla Capital, a Capital Markets company and FirstPhase Capital where he was head of research. At10xAlerts, he writes articles and conducts interviews on many sectors, including breaking news technology, metals & mining markets.