Alset Capital Inc. (TSXV: KSUM) (FSE: 1R60) (WKN: A3ESVQ) (“Alset” or the “Company”) is an issuer focused on investment in diversified industries such as technology, healthcare, industrial, and special situations, operating businesses through debt and equity using cash resources or shares in its capital.

Alset has two primary investment arms: Cedarcross International Technologies Inc. (“Cedarcross”) (49% Ownership). Cedarcross’ mission is to democratize access to high-performance AI computing.

Vertex AI Ventures Inc. (“Vertex AI”) (49% Ownership) is focused on identifying AI technology, acquiring and licensing intellectual property (IP), and providing data management services. Here’s the Corporate Deck.

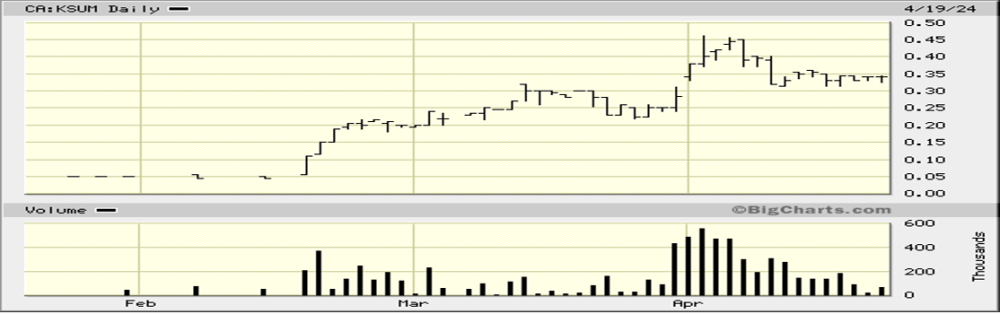

The impressive chart action results from deals and agreements closed by Alset and its subsidiaries.

Case in point: a recent agreement between Cedarcross and Earthmade access to behemoth Super Micro Computer, Inc. (NASDAQ: SMCI). The deal gives Cedarcross direct access to Nvidia GPU HPC hardware through SuperMicro. It’s not as complicated as it sounds, even if you merely understand the importance of such a deal.

“This Agreement is a testament to our commitment to providing HPC AI hardware solutions,” said Greg Lui, CEO of Earthmade. “By facilitating Cedarcross’s access to Nvidia’s GPU HPC hardware, we are strengthening our relationship with Alset and Cedarcross and reinforcing our position in the AI computing supply chain. We look forward to the innovative advancements that Cedarcross will achieve with this high-performance computing power.”

The only thing better for a small company to do besides delivering great ongoing growth is when those companies start playing in the big boys’ sandbox. Depending on the parameters, the big boys, such as the ‘Magnificent Seven,’ spend 24/7 monitoring their and competitor’s products. (NDVA is one of the ‘Magnificent Seven’ techs dubbed as such) when each delivered an average gain of 112% last year, which blew up the 24% return of the S&P 500 index.

This week, shareholders holding almost 13 million units of KSUM have agreed to voluntary restriction on any disposition or sale of shares;

The Company is pleased to announce a positive development that certain shareholders have entered into a Voluntary Pooling Agreement (the “Pooling Agreement”) or Undertakings, which shall collectively place voluntary restrictions on the disposition or sale of 12,726,665 units of the Company. The detailed Release Schedule is provided below.

“We are encouraged by the Applicable Subscribers’ decision to enter into the Pooling Agreement and Undertakings, as it signifies their strong belief in Alset’s long-term vision and our collective journey towards value creation for all shareholders,” said Morgan Good, CEO of Alset.

NEXT? Private Placement

The Company also announces a Non-Brokered Private Placement of Units of the Company (the “Units“) for $0.25 per Unit for aggregate gross proceeds of up to $2,500,000 (the “Offering“).

Each Unit is comprised of one (1) Common Share and one-half of one Common Share purchase warrant (each whole Warrant, a “Warrant“). Each Warrant entitles the holder thereof to acquire one (1) additional Common Share (each a “Warrant Share“) for $0.40 per Warrant Share for a period of 36 months from the date of issuance.

NEXT? Growth

No one can deny the potential of this unique Company. For no apparent reason, I mention, that, unlike most companies, its Press Releases are not a pedantic, boring or verbose exercise.

Given that a lot of what Alset et al does, most need to be more geeky to be able to explain the products, structures, processes, and rapid growth of the AI sector. Putting Alset in the same breath as behemoths (yes, Martha, I used it twice) SuperMicro and Nividia is almost enough.

Bob Beaty

For over 30 years, Bob Beaty has been explaining concepts and companies to the global investment community. One of the original writers for Jim Cramer’s Thestreet.com, he also wrote for AOL (Can/US), the Globe and Mail, and the Huffington Post. Over that period, he illuminated small-cap companies to investors with wit and pith but mostly opinion and facts. Investing should be fun. Pedantic, staid content is no fun.

Before embarking on his writing career, Bob had a successful international journey in the finance industry. He served as a broker, derivatives product manager, and a Director of London's Credit Suisse subsidiary. His career spanned across major financial hubs including Toronto, Vancouver, and the UK, giving him a unique global perspective. (He is still fondly remembering those English client lunches.)

Other than everything Groucho Marx and George Carlin ever said, Bob lives by a simple credo;

‘Never do anything the person standing in front of you can't understand.’ Hunter S. Thompson.

Let’s go.