JOURDAN RESOURCES INC. (TSXV: JOR; OTCQB: JORF; FRA: 2JR1) (“Jourdan” or the “Company “) is focused on the acquisition, exploration, production, and development of Lithium mining properties in lithium, primarily in Quebec.

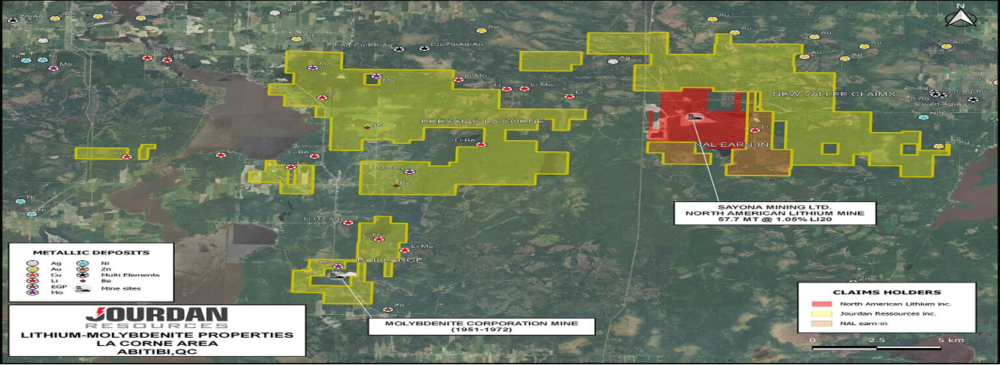

Not surprisingly, about a week ago, the Financial Post lauded the restart of the North American Lithium Mine—owned by a JV of Sayona Mining and Piedmont Lithium– which, as you can see below, Jourdan pretty much surrounds.

Here’s the link to the company’s latest video, posted less than a week ago. It features Roger Lemaitre, VP and Head of Mining.

Anyone looking for evidence of the green economy in Canada would do well to drive about six hours north of Montreal to the town of La Corne in the Abitibi region of Quebec, where the first — and for now the only — large-scale lithium mine in North America has begun operating. The new owners of the La Corne mine estimate it will produce 120,000 tonnes of hard rock lithium spodumene this year and 226,000 tonnes yearly once it is in full swing. Tesla Inc. and South Korea’s LG Chem Ltd. are already buyers. (Financial Post)

That might be true for now. JOR boasts three unique properties in Quebec; Vallee Lithium, Baillarge Lithium-Moly and Pressiac-La Corne Lithium. We’ll look at the salient points of each once we get to the lithium market today. For anyone who needs to learn how robust lithium is and as demand outstrips supply, JOR is an exciting Company.

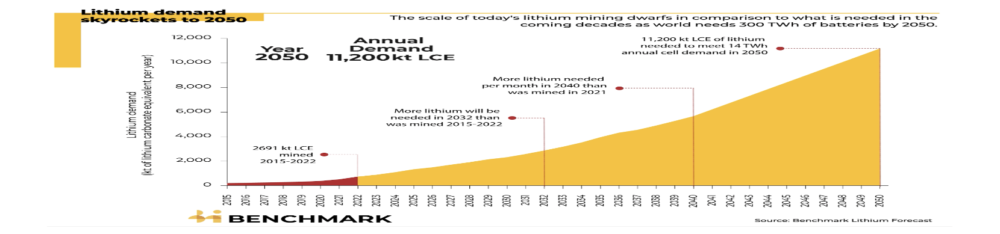

Lithium Market. Current price; Lithium Carbonate (99.5% Battery Grade) (USD/mt) 28,503.29-31,702.64 range, Current price 30,102.90 Change -436.27 Apr 10, 2023. The supply-demand forecast is also robust, as shown by the chart below. 2050 is a long time away, but the trend favours producers.

Benchmark Mineral Intelligence, a leading entity tracking and analyzing lithium market information, concludes that the lithium market needs to scale up to 25 times or more of the 2021 level by 2050.

In January 2023, Tesla amended its agreement with Piedmont Lithium (ASX: PLL, NASDAQ: PLL), which is now set to supply the US automaker with spodumene concentrate from the past-producing North American Lithium operation — a project Piedmont is developing with Sayona Mining (ASX:SYA, OTCQB: SYAXF). Under the amended agreement, the ASX-listed company will deliver approximately 125,000 MT of spodumene concentrate to Tesla in the second half of 2023 through to the end of 2025. (Investing News Network).

Jourdan Properties La Corne Area, Abitibi Region in Quebec. (Comparison of 2011 and 2021 drilling).

- Vallee Lithium; contiguous and in proximity to RB Energy’s Quebec Lithium Property and adjacent to North American Lithium Mine. The mineralized Spodumene Pegmatite dykes that North American Lithium is mining continue directly onto the claims of Jourdan.

- The property encompasses the southern part of Mont Vidéo and frames the north and east of Lac Legendre. It consists of 48 cells designated on a map covering surveyed intra-municipal lots covering 1997 hectares.

- Jourdan and Sayona plan to undertake the most extensive lithium drill program in Quebec, set to start in May 2023.

Jourdan CEO and President Rene Bharti commented: With Jourdan having over 13,000 hectares of land surrounding NAL’s project, the opportunity to partner with NAL and Sayona to accelerate Jourdan toward production is evident. Given that the NAL concentrator has commenced operations, Jourdan is in a short position to benefit from having access to what we expect will become Canada’s leading lithium-producing mine and concentrator. (PR Mar 07)

Sayona’s (75% owner of the North American Lithium Mine) Managing Director, Brett Lynch, added: “Sayona is excited to be partnering with Jourdan as we undertake a large scale and extensive drill program at NAL and the Earn-in Claims. The combined drilling program will be undertaken in consultation with our local community stakeholders, to pursue a bigger mineral resource base and better grades in the Abitibi Hub capable of delivering increased ore tonnages to the NAL concentrator and a longer life-of-mine. With the production of saleable lithium concentrate at NAL only days away, this is an exciting time for Sayona and Quebec as we work to build what we believe to be the leading lithium production centre in North America.”

And obviously, Jourdan is in the thick of the development. The mind wanders to further corporate JVs or other relationships to build the area; bigger, faster and with a more global punch.

- Baillarge Lithium-MolyThe Baillargé-Est in Abitibi, in the township of La Corne on Map 32 C 05 (NTS). It consists of 35 claims and is positioned 38 kilometres north of Val d’Or and about 30 kilometres southwest of the village of Barraute. The property also covers about three-quarters of Lake Baillargé. The area thus formed is 1299 hectares.

- It has been the subject of 14 surveys, including sampling results of 2.48% Li2O or 1.15% Li over 2.30m.

- The property is at a preliminary stage of its exploration. Much work remains to be done before producing a substantial evaluation.

Mine assessment reports are available on the JOR site from 1956 to 2011. (For historical context). The Company announced an aggressive drilling plan for Baillargé in early March 2023.

- Preissac-Lacorne Property consists of a set of 161 mining claims which covers surveyed intra-municipal lots and is composed of three distinct blocks informally named here: the main Preissac-La Corne block, the Duval Lithium block and the La Motte block.

- The total surface area of the area is 7173 hectares.

- The Preissac‐La Corne sector is crossed by numerous pegmatites and aplites, which seem to have been placed in the fractures and joints. They consist of albite, potassium feldspar, quartz, muscovite, garnet, beryl, spodumene, molybdenite and colombo-tantalite.

- The property is still at an early stage of exploration.

Bottom Line

Initially, investors would do well to focus on Jourdan’s flagship Vallee Lithium. The JV with North American Lithium has only positive aspects; compelling reserve prospects, large partners, and the possibility of more joint venture relationships or some more formal arrangement.

Lithium demand is not retreating anytime soon, so picking a proxy to participate. While there are a few junior miner choices, JOR offers land placement, well-financed partners and the added kicker of participating in the more advanced (with aggressive development plans) mine it surrounds. (It’s the one in red on the map).

Please put it on your watch list or start a buying program.

BTW, from time to time, I may own shares. I do not, currently.

Sponsored Post