- Zonia Project: Expected production within 3 to 5 years with significantly lower costs compared to conventional concentrate operations.

- Escalones Project: Boasts a post-tax NPV of $1,499.6 million at $3.60/lb copper and a substantial resource expansion potential.

- Strategic Positioning: Positioned to supply the increasing copper demand from AI, renewable energy, and electric vehicles sectors.

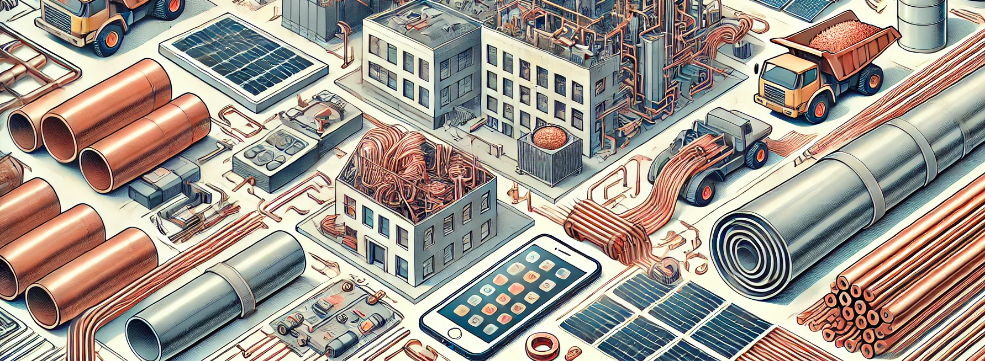

Investing in artificial intelligence (AI) can be risky due to market volatility, rapid technological changes, and potential regulatory challenges. However, investing in copper exploration companies presents a more stable and promising opportunity. Copper is essential for AI development, as well as for renewable energy systems and electric vehicles. The increasing demand for these technologies ensures a growing need for copper. With copper prices projected to rise by 20% over the next five years, copper exploration companies are poised for significant growth, offering investors a less risky and highly profitable alternative to direct AI investments.

The Importance of Copper for AI

Copper plays a critical role in the advancement and functionality of artificial intelligence (AI) systems. First, it is a key component in the production of semiconductors, with copper accounting for 70% of the material used in semiconductor wiring due to its superior electrical conductivity. This enhances the efficiency and performance of AI processors, which are the brains behind AI algorithms and computations. Additionally, copper is essential in the construction of data centers, where AI models are trained and deployed. These data centers contain extensive cabling and cooling systems, with copper wiring and heat exchangers making up 60% of the infrastructure. Furthermore, the rapid increase in AI applications, projected to grow by 40% annually, will drive a proportional rise in the demand for copper, highlighting its indispensable role in the AI industry.

In terms of pricing, copper currently trades at around $4.67 per pound, with industry analysts predicting a 20% increase over the next five years due to the surge in demand from AI and other technologies. Beyond AI, copper is extensively used in renewable energy systems, electric vehicles, and general electronics, making up 30%, 10%, and 60% of the material in these sectors, respectively.

Meet World Copper, an Exploration Company Surfing on the Copper Opportunity

World Copper (TSXV: WCU | OTC: WCUFF | FRA: 7LY0) is a mineral resource company focused on developing two promising copper oxide projects: Zonia in Arizona and Escalones in Central Chile.

World Copper’s Strategic Focus on Zonia Project

Flagship Asset Development

World Copper is prioritizing the Zonia Project in Arizona as its flagship asset, aiming to advance it to a bankable feasibility study, followed by construction and production. The company’s goal is to put the asset into production within 3 to 5 years, with significantly lower costs compared to conventional concentrate operations. This strategic focus on Zonia is driven by its favorable economics and development potential, making it a cornerstone of World Copper’s growth strategy.

World Copper has adopted a two-phase plan for the Zonia project. Phase one targets the portion of the project located on private land, involving environmental studies, land and water use permits, metallurgical studies, mine planning, and construction planning. Phase two focuses on permitting and exploring the non-private BLM land surrounding the Zonia site. This area, three times the size of the private land, holds significant potential to increase the copper resource exponentially. Both phases will be conducted in parallel to streamline the development process.

Economic Assessment

The historical Preliminary Economic Assessment (PEA) from 2018 demonstrated excellent project economics for Zonia. The PEA outlined an open-pit, copper-oxide heap leach project with a 9-year mine life and favorable economics, using a base case of $2.00/lb copper. The updated mineral resource estimate, as of February 2023, includes 75.7 million short tons grading 0.30% total copper (Indicated Resources) and 122.0 million short tons grading 0.24% total copper (Inferred Resources), significantly expanding the historical resource estimate. These numbers provide a strong foundation for advancing Zonia through feasibility and into production.

“ In mining projects, any opportunity to start production early and to generate revenue right from the start of the operations, can greatly

improve the economics of the project increasing the net present value (NPV) and reducing the financing needs, making the project more robust, and lowering the execution risk.”

Mr. Gord Neal, CEO of World Copper

Escalones Copper Project Overview

Project Highlights

World Copper’s Escalones copper porphyry project is located 35 km east of El Teniente, one of the world’s largest underground copper mines, within the Chilean porphyry copper belt. The project benefits from excellent infrastructure, including road access, electricity, seaports, and a gas pipeline crossing the 70 square km property. Escalones was discovered in 1996 and redefined as a copper oxide deposit in 2020, enhancing its value by lowering capital and operating costs compared to a sulphide flotation project.

Economic Assessment

The 2022 Preliminary Economic Assessment (PEA) reported a post-tax NPV of $1,499.6 million at $3.60/lb copper and $1,822.4 million at $4.00/lb copper. The first five years of production are expected to yield an average of 124.7 million pounds of copper annually, with life-of-mine (LOM) costs averaging $1.19/lb Cu. The initial capital expenditure is estimated at $438.4 million, with sustaining capital over the LOM projected at $192.5 million. The conventional heap leach, SX-EW processing facilities target a daily placement of 50,000 tonnes.

Escalones hosts inferred resources of 426 million tonnes grading 0.367% copper, totaling approximately 3.45 billion pounds of copper. The mineralization, which is largely oxidized, is suitable for heap leaching, with an average recovery of 71%. The geology includes quartz-sericite, potassic, and calc-silicate alteration assemblages, with copper occurring as primary sulphides chalcopyrite, bornite, and covellite, and replaced by secondary copper oxides, sulphides, sulphates, and carbonates within 300 meters of the surface.

Exploration Potential

The Escalones deposit has significant expansion potential, especially to the south, east, and west, with only half of the alteration zone drilled to date. The Mancha Amarilla lithocap extends one kilometer south from the main deposit, showing signs of deep oxidation and potential soluble copper mineralization. Recent geochemical sampling and mapping, along with drill programs, indicate substantial expansion opportunities, particularly in the East Skarn area.

Conclusion

World Copper World Copper (TSXV: WCU | OTC: WCUFF | FRA: 7LY0) is strategically positioned to meet the growing demand for copper driven by advancements in AI and other technologies. By focusing on their flagship Zonia project in Arizona and the promising Escalones project in Chile, World Copper aims to leverage their favorable economics and development potential. Zonia is expected to begin production within 3 to 5 years, offering a cost-effective solution to the copper supply deficit. Meanwhile, Escalones boasts a significant NPV and expansive resources, underscoring World Copper’s robust potential in the copper market.

Posted on Behalf of World Copper

Marc has been involved in the Stock Market Media Industry for the last +5 years. After obtaining a college degree in engineering in France, he moved to Canada, where he created Money,eh?, a personal finance website.