August 19th

Marc ZERBOLA CHALLANDE

Fandifi (CSE: FDM) (OTCQB: FDMSF) (FSE: TQ4) hosted on August 11 a live corporate webinar and introduced fan engagement technology. It is time to bring more details about how exciting the company is. Fandifi is building a crowd-based and system-generated prediction fan engagement platform. The Fandifi platform runs on an associated neural network tailor-made for content creators to increase the Gamification of their content and enable fan engagement within their communities regardless of distribution.

Company Overview

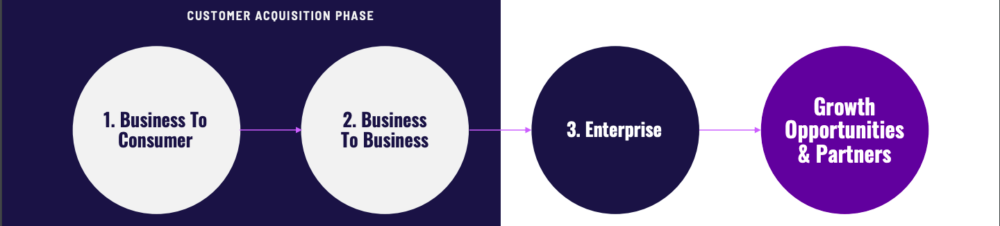

Fandifi helps to bring engagement. Indeed the company empowers global content creators with a unique crowd-based and system-generated prediction engine that increases fan engagement and satisfaction through unique content. The company can expand into every industry with fans, including movies, music, live events, fashion, food, and more. About Fandifi’s timeline, the company plans to execute its 1st phase in Q3 2022, where it will launch its B2C Fandifi platform with bespoke content and an open platform for gaming. In the last part of the year 2022, Fandifi will launch its B2C platform across other industries and will secure partnerships. The market is enormous and keeps growing. With an audience that needs to be more engaged, Fandifi makes content more social and engaging with Gamification through prediction and analytics. There is a decline in the 55 and 18-34 years old viewing Live TV. The young population watched 23.4% less live TV in 2020 vs.2019. Fandifi helps to close the gap between the viewer and the action, making every minute engaging.

“Sports leagues, especially Major League Baseball, are seeing declines in younger viewership. The change comes as people turn away from traditional TV viewing and toward social media, video games and streaming TV” – Wall Street Journal,

Management Overview

David Vinokurov (CEO)

David is a seasoned capital markets professional involved in numerous aspects of corporate management and deploying capital market strategies for publicly listed companies. David is a focused, determined, competent member of management and advisory boards of companies in the gaming, esports, igaming, technology, fintech, and natural resource sectors.

Renjun Bao Ph.D. (Advisory board)

Mr. Bao is a renowned thought leader with extensive sports industry knowledge in China and USA and has worked with many major international leagues. Mr. Bao currently serves as the Director of Business Development. He is a Senior Sports Reporter for Tencent Sports America. He is responsible for maintaining top-tier relations with major sports leagues for which Tencent has exclusive broadcast rights for the Chinese market.

Share Structure/Financials

For an emerging tech company, Fandifi has strong fundamentals. On the balance sheet side, the company has $4M in total assets with $2.5M in cash and cash equivalents. The company also has no debt, which leads Fandifi to have a clean balance sheet. In the three months ended April 30, the company’s most significant expenses were the platform and development costs which represented $319k.

About the share structure, the company has 82M shares outstanding, with 25% held by management, board & key investors. Fandifi also has 35M warrants which could bring $10M if they are all exercised (min. price: $0.10 and max. price: $0.50), and 8.5M options representing $2.1M in cash (min. price: $0.09 and max price: $0.50). Fully diluted, there are 126M shares. If the company manages to increase its market cap and share price, it could enable Fandifi to exercise its warrants and options and have a healthy dilution. During the year 2022, no trades on the market have been made by insiders.

Because the company has an emerging business, the ongoing concern written in the financial statement explains the company still couldn’t finance day-to-day activities through operations. The company’s continuation as a going concern is dependent upon the successful results from the development and monetization of the Company’s Entertainment Platform for sports and esports superfan engagement and the related mobile applications and its ability to attain profitable licensing and advertising-based operations and generate funds from and/or raise equity capital or borrowings sufficient to meet current and future obligations, all of which are uncertain. If, as mentioned above, the company plans to cover the operating costs over the next twelve months from related parties, the exercise of stock options, and warrants, the company could also get funds generated from private placements.

Share Movement

Fandifi’s stock price is currently worth $0.12 for a $9.5M market cap. If the stock went to a 52-week high of $0.25 on April 4, it went on a continuous downtrend to reach its 52-week low of $0.075 on June 30.

About stock performance, it just gave a positive return on investment if you invested a month ago (43.7%). If you bought it other times, the stock gave -45% Year-over-Year and -28% in the last three months.

The technical side indicates the stock is currently a BUY, with 10 Buy, 11 Neutral, and five sell signals. RSI and RSI-based MA data indicate the stock is neither overbought nor oversold (30 and under, 70 and above) as these data represent 53 and 52. Its Moving Averages show the stock is in a downtrend with its Simple MA (200) worth $0.145and above its Simple MA (50) worth $0.105.

Bottom Line

-Fandifi is building a crowd-based and system-generated prediction fan engagement platform;

-The company has $2.5M in cash, has 25% held by insiders & key investors, and is currently a BUY according to technical;

-It has options and warrants which could help the company to fund its operations if exercised;

-Mr. Bao is part of the advisory board; he is a renowned thought leader with extensive sports industry knowledge in China and USA;

-Fandifi is traded in Canada, the USA, and Germany (CSE: FDM) (OTCQB: FDMSF) (FSE: TQ4).

Sponsored Post

Marc has been involved in the Stock Market Media Industry for the last +5 years. After obtaining a college degree in engineering in France, he moved to Canada, where he created Money,eh?, a personal finance website.

All Articles

Terms & Policies

Privacy Policy

Disclaimer/Terms of use

Subscribe

©2024 10xAlerts