All we ever read is the standard ‘Henny penny, Henny Penny, lithium supply is falling!

So, let’s get educated about this metal—plenty of time for the other stuff. If EVs hadn’t come along, this metal would remain an industrial component, a mental health drug, and otherwise mind its own business.

- Lithium (from Ancient Greek λίθος (líthos) ‘stone’) is a chemical element; it has the symbol Li and the atomic number 3. It is a soft, silvery-white alkali metal. Under standard conditions, it is the least dense metal and the least dense solid element.

- Lithium has the least stable nucleus of all the nonradioactive elements, so much so that the core of a lithium atom is on the verge of flying apart. This makes lithium unique and especially useful in specific nuclear reactions.

- Mildly concerning, lithium has the least stable nucleus of all the nonradioactive elements, so much so that the nucleus of a lithium atom is on the verge of flying apart. This makes lithium not only unique but especially useful in specific nuclear reactions.

- This one is a beauty. Lithium is believed to be one of only three elements – the others are hydrogen and helium – produced in significant quantities by the Big Bang. These elements were synthesized within the first three minutes of the universe’s existence.

- Lithium ions in lithium carbonate – are used to inhibit the manic phase of bipolar (manic-depressive) disorder.

- Lithium chloride and bromide are used as desiccants. (a hygroscopic substance used as a drying agent)

- Lithium stearate is used as an all-purpose and high-temperature lubricant.

- Oh yes, and ongoing and robust key EV battery component.

All that said, without much more detail, investors would likely be wise to strap on a lithium proxy stock(s).

Here is a great opportunity that suits those so inclined.

Give your portfolio a LI-FT. (I couldn’t resist)

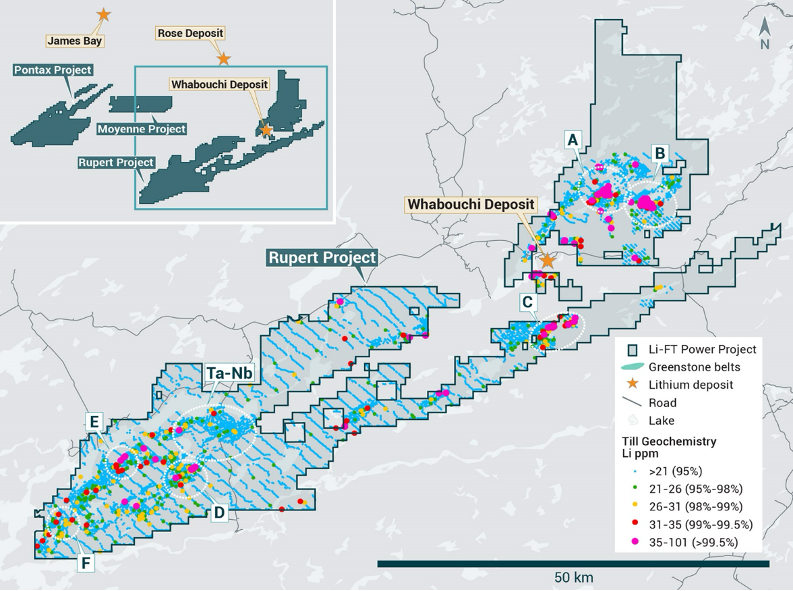

Li-FT Power Ltd. (“LIFT” or the “Company”) (TSXV: LIFT) (OTCQX: LIFFF) (Frankfurt: WS0) is a mineral exploration company engaged in the acquisition, exploration, and development of lithium pegmatite projects located in Canada.

Investors will note that LIFT is a great trader and has a reasonably high volatility component.

The world produced 540,000 metric tons of lithium in 2021, and by 2030, the World Economic Forum projects that global demand will reach over 3 million metric tons.

Drilling has intersected significant intervals of spodumene mineralization, with the following highlights:

Highlights:

| • | YLP-0107: | 13 m at 1.24% Li2O (Echo) |

| And: | 5 m at 0.62% Li2O | |

| And: | 2 m at 0.76% Li2O | |

| • | YLP-0101: | 13 m at 1.28% Li2O, (BIG East) |

| And: | 5 m at 1.30% Li2O | |

| And: | 2 m at 0.59% Li2O | |

| • | YLP-0098: | 13 m at 1.27% Li2O, (Ki) |

| And: | 5 m at 0.63% Li2O | |

| Including: | 2 m at 1.25% Li2O | |

| • | YLP-0094: | 11 m at 1.38% Li2O (Shorty) |

Francis MacDonald, CEO of LIFT, comments, “The first drill results from our Echo target have been a positive surprise. Our model at the time indicated that the pegmatites were steeply dipping. What we discovered after drilling the first hole was that there are three separate pegmatite bodies that are shallowly dipping at depth. This geometry is very favorable for mining. We look forward to releasing additional drill results from Echo and to continue drill-testing this target in the upcoming drill program which is scheduled to start in January 2024.”

The fact is that LIFT has almost CDN18 million in cash and NO DEBT. Nada.

Canaccord Genuity research takes the share price up to CDN13.00.

Key to owning LIFT is this fact which bears repeating;

Investors need to note the large Whabouchi Deposit as it is one of the largest high-purity lithium mines in NA and Europe. Nemaska Lithium owns it. The company is, of course, domiciled in Quebec.

There needs to be more argument that every portfolio should likely have a lithium/critical metals component. While several companies are out there, the properties’ quality and the management’s strength should lean investors into LIFT.

Sponsored Post on Behalf of Li-ft Power