And great drill results keep on coming.

Li-FT Power Ltd. (“LIFT” or the “Company”) (TSXV: LIFT) (OTCQX: LIFFF) (Frankfurt: WS0) is a mineral exploration company engaged in the acquisition, exploration, and development of lithium pegmatite projects located in Canada.

· Holes (drill holes) are at BIG West, Nite, and Ki.

Highlights:

· YLP-0177: 11 m at 1.52% Li2O, (Nite)

· and: 1 m at 1.19% Li2O

· YLP-0179: 12 m at 0.64% Li2O, (Ki)

· including 3 m at 1.39% Li2O

· and: 5 m at 0.56% Li2O

· including 2 m at 1.22% Li2O

CEO Francis MacDonald states, “This week’s results show the high-grade nature of the Nite pegmatite. 11 meters at 1.52% Li2O is an excellent result and shows that there is further potential along strike to the southwest and downdip at the Nite pegmatite.”

A ‘pegmatite’ is an igneous rock created underground when interlocking crystals form during the final stages of a magma chamber’s cooling, with pegmatite crystals a primary source of lithium.

I have mentioned before the volatile nature of LIFT shares. With a 52-week range of CDN4.38 to CDN10.37 and a current price of about CDN4.70, it might be tempting to watchlist or pick up a few shares. Your choice.

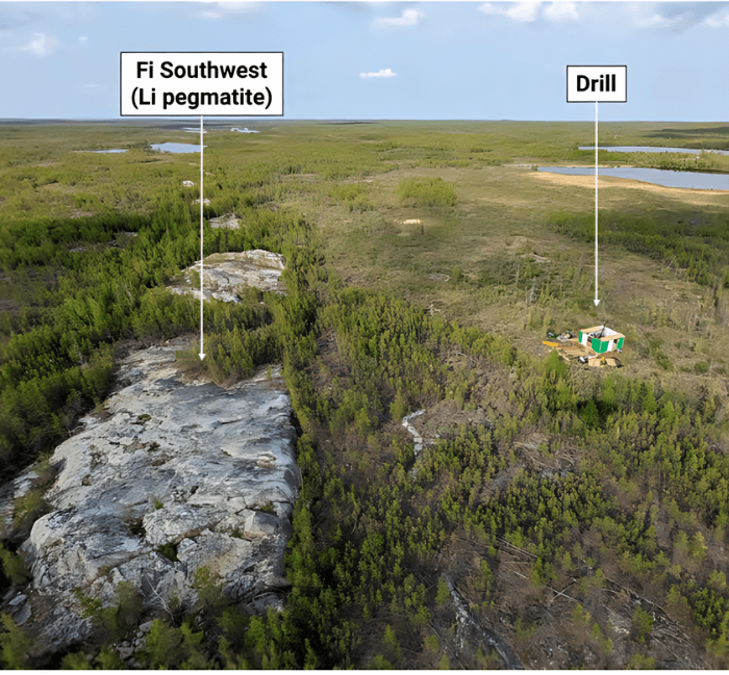

From a recent Katusi Research report, I love this picture, the CEO Francis MacDonald and with a chunk of lithium among a LOT more just lounging on the surface. (Right) Left is said chunks just laying there waiting for fame and fortune

Salient Facts for Investors

· Katusi’s research makes the following observations, which should appeal to investors who live under a rock. (see how I did that)

· This deposit has a lithium-containing rock that can be seen on the surface.

· “We’re hitting on 80–90% of our drill holes,” the CEO says.

· Early Li-FT investors poured in as much as 15 million dollars EACH into the company to acquire the Yellowknife Project and start defining how much lithium is in the ground.

· That money has yet to pay out ‘bonuses’ or waste.

· The CEO Francis is plowing most of the cash into fast-tracking Yellowknife by drilling to determine HOW MUCH lithium is there.

· Now, it’s drilling down 200–300 meters and determining how big this project is.

I believe that car companies et al. are scrambling for lithium before a perceived shortage by 2025. Katusi has a great line in its report;

What’s unfolding is an escalating, no-holds-barred brawl for lithium supply.

So they are buying current and future production. You might soon LIFT in that number.

Posted on Behalf of Li-ft Power