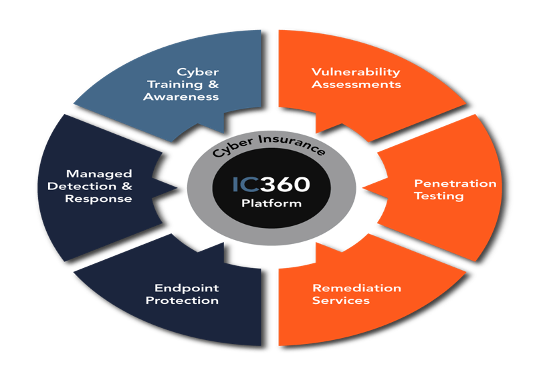

Integrated Cyber Solutions (ICS: CSE) Inc. delivers Cybersecurity managed services to the small-to-medium business and small-to-medium enterprise segments. Its proprietary services include managed detection and response, endpoint detection and response, vulnerability management and assessment, penetration testing, dark web scanning, remediation, security awareness and training, and cybersecurity insurance.

In other words, ICS keeps your data, systems, etc., safe from incursion, exploitation and expensive data theft or corruption.

As an investor, today is your lucky day: ICS is listing on the CSE as of the October 10th, 2023 opening.

There are few opportunities to get in on the ground floor of a nifty company like ICS. If you doubt me, check out management bios. You will be impressed. And confident in the Company’s prospects and potential

The wheel shows the components ICS uses to accomplish client solutions.

Discussing this topic would make getting lost in the cyber weeds easy. While the minutiae and processes are likely complicated—and not available for public perusal—the point is simple. Protection.

The Market

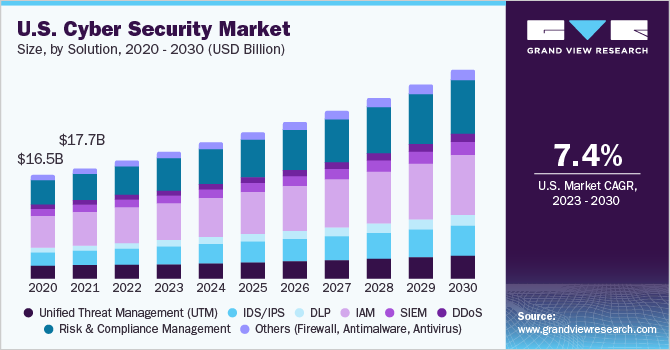

The global cyber security market was estimated at USD 202.72 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 12.3% from 2023 to 2030.

Why the significant growth? Mainly due to the demand for endpoint security solutions. The main clientele are startups, retail and financial entities.

On a grand scale, as we saw this weekend in the horrific attacks in Israel, the first things to be compromised and hacked were computer systems.

The future is not just in dealing with cyber threats but staying several jumps ahead of the bad guys, internal or external.

Cybersecurity is one of the fastest-growing technology industries because it’s essential to staying at the top of your game in business.

Even more so as cyber threats continue to grow and become more sophisticated, companies must find a way to avoid being caught unprepared.

“Cybersecurity is a lucrative industry because it’s fraught with opportunities for savvy entrepreneurs who can see and seize them from the beginning. … Cybersecurity is essential to a company’s infrastructure, but many businesses fail to invest adequately in their digital security. This leaves them open to cyber attacks, which will cause significant financial losses and harm company reputations”. (Ayoka Systems)

The opportunities for companies like ICS are myriad. The central tenet is system protection and shielding. ICS will simulate an attack on your systems to establish a level of need. This exercise shows the steps to resolve vulnerabilities and secure client data.

Key to all of this is employee training: As the first line to identify threats and ultimately prevent breaches. ICS monitors and manages your systems to further enhance security.The number of publicly traded cybersecurity companies is relatively low: Cisco, Palo Alto Networks and Fortinet are the leading cybersecurity vendors worldwide. In the first quarter of 2020, Cisco accounted for 9.1 percent of the market share in the cybersecurity industry, while Palo Alto Networks and Fortinet accounted for 7.8 and 5.9 percent, respectively.

There is also a small but healthy M&A market in the sector.

“Concerns over financial losses are positioned to bolster the growth of the sector, as global cybercrime damages are projected to total $8 trillion in 2023 and reach $10.5 trillion by 2025, according to Cybersecurity Ventures” (Capstone Partners)

Bottom Line

Lots of reasons to own some ICS. As with any IPO, a dollar cost-averaging strategy might be prudent. At the very least, it needs to be on your watchlist.

I can’t think of a world that doesn’t need Cybersecurity now and more into the future. As mentioned, you rarely get to purchase a startup of this quality.

Look at a long-term chart of Cisco. Point made.

Posted on Behalf of Integrated Cyber