TAG Oil Ltd. (TSXV: TAO and OTCQX: TAOIF) (“TAG Oil” or the “Company“), based in Vancouver, BC, focuses on operations in the Badr Oil Field in the Western Desert of Egypt. The Company is a unique MENA (Middle East North Africa) oil play.

‘MENA’ is the largest global oil reserve, with 57% oil and 41% natural gas. Together, OPEC Member Countries in MENA have 840 billion barrels of proven crude oil reserves. They also control around 80 trillion cubic metres of proven gas reserves.

“While I believe in pursuing all sources of sustainable energy, oil and gas will continue to be a significant supplier of the energy mix for decades. MENA is a region with significant growth potential, and our team has the track record, expertise and unified vision to get the job done.” Abdel Badwi, TAG Executive Chairman.

N.B. Recent released six-month numbers state that highlights over the period include that the Company had C$23.0 million (June 30, 2023: C$15.5 million) in cash and cash equivalents and C$24.7 million (June 30, 2023: C$17.9 million) in working capital and has no debt.

Recent Developments include;

- Closed a CDN12.3 million bought deal

- Drilling at Badr Oil is underway

- Good oil shows at Abu Roash ‘F’ (ARF) as drilling continues

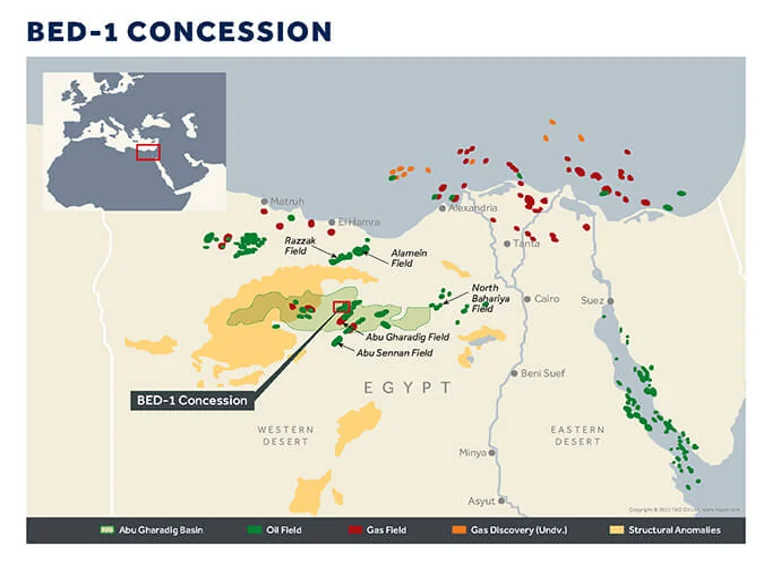

- The BED 1-7 well has been in production since April 2023 and has reached a cumulative production of approximately 10,000 barrels of oil from the ARF.

- Arf’s success opens future planning for the BED-1 field.

Many of the 13 OPEC nations are within the MENA region. While no standardized list of countries is included in the MENA region, the term typically comprises the area from Morocco in northwest Africa to Iran in southwest Asia and Sudan in Africa.

Let’s review the properties as MENA is, globally, extensive and unique.

TAG holds an interest in the Badr Oil Field (“BED-1”), a 26,000-acre concession located in the Western Desert, Egypt, through a Production Services Agreement (“PSA”) with Badr Petroleum Company (“BPCO”).

Research Capital follows TAG and has made these projections;

RATING & TARGET PRICE Price Target Market Cap ($M) Projected Return

SPECULATIVE BUY current C$0.50 projected C$1.25 Projected Return 115.5%

Market Cap C$104.70

TAG remains debt-free, and we estimate the Company has a current positive working capital of ~ $25mm.

(Bill Newman, CFA Research Capital)

Any expansion of the Israel-Hamas war, depending on severity, could cause oil to rise to between USD100 a barrel and US157. The highest oil price on record was in July 2008, when Brent traded as high as $147.5 per barrel, according to data from LSEG.

Currently, no MENA-specific ETFs in the U.S. encompasses the entire region. Instead, American investors can only access through several sub-regional or country-specific ETFs.

Given the paucity of vehicles allowing investors MENA exposure (some country-specific ETFs), TAG should be a serious consideration for investors who want to plug in a global, massive, and active oil area.

MENA covers a surface of over 15 million square kilometres and contains about 6 percent of the world’s population, about the same as the European Union’s (EU) population. The three smallest countries (Bahrain, Djibouti, and Qatar) each have a population of about half a million inhabitants.

By contrast, the two largest countries (Egypt and the Islamic Republic of Iran) comprise about 60 million inhabitants each. Together with Algeria, Morocco, and Sudan, these five most populated countries account for about 70 percent of the region’s population. Almost half the population lives in cities.

MENA should likely have a place in your watchlist/portfolio or both. As well as an oil proxy, it drops you directly into the world’s largest oil area.

Oh yes, in case you forgot;

TAG has lots of cash and no debt.

If an investment in TAG goes well, you’ll have lots of cash and no debt.

Posted on Behalf of Tag Oil