Tinka Resources Limited (“Tinka” or the “Company”) (TSXV & BVL: TK) (OTCQB: TKRFF) owns an impressive portfolio of Silver, Zinc and Lead assets in central Peru. Let’s look at the Company’s main property, the Ayawilca Zink-Silver Project.

The Ayawilca Zinc zone is 100% owned by Tinka and is one the most significant zinc-silver resources owned by a junior.

Management believes this property could be one of the ten largest global zinc producers.

The 170 km2 project is located 4km northwest of Cerro de Pasco in Central Peru.

Tinka’s president and CEO, Dr. Graham Carman, stated: “The ultra-high-grade zinc intercept in A22-202 is a potential game changer for the Ayawilca project. The interval of 10.4m grading 42% zinc consists of almost pure zinc sulphide mineralization, while part of this interval grading ~50% zinc reflects the zinc concentrate grade accepted by smelters. Importantly, the mineralization is relatively shallow (~140m depth) and comes from an area of the resource that could be accessed early in a mine plan.” (The Assay)

Some investors may think Zinc is boring—Au contraire. The supply-demand scenario leans heavily toward significant, long-term growth.

NI 43‐101 Technical Report on Updated Preliminary Economic Assessment; Ayawilca Polymetallic Project (November 10th, 2021).

The Case for Zinc

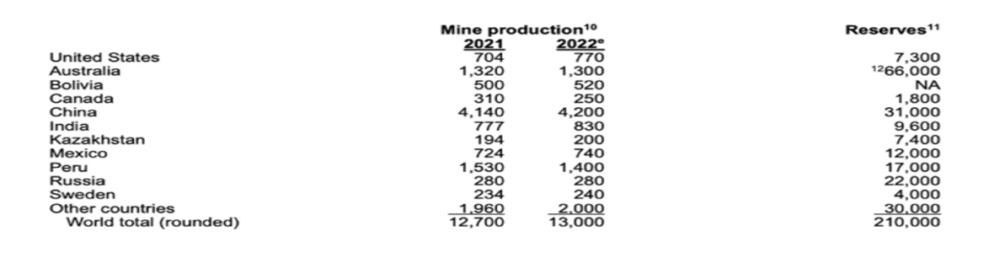

While a proxy for the growth of Zinc, Tinka finds itself right in the middle of an impressive growth picture favouring new supply. The global zinc demand for renewable energy technologies is forecast to continuously increase during the next decade, from 109,300 metric tons in 2020 to 364,000 in 2030. Solar energy is expected to account for the largest share of this zinc consumption, with a forecast volume of 162,000 metric tons in 2030.

“So far, the zinc-ion battery is the only non-lithium technology that can adopt lithium-ion’s manufacturing process to make an attractive solution for renewable energy storage, particularly for its compatibility along with other advantages,” Power Magazine states.

In one instance, many NiZn batteries are being tapped for inclusion in new US submarines and retrofits. I chose this example so I could put it in a nifty sub pic. Go to the third image.

While the above is a bit dramatic, it shows the level at which Zinc is essential to ‘green’ a myriad of power delivery systems from subs to home technology.

Zinc-ion batteries can improve upon lithium-ion manufacturing processes. Lithium’s violent reactivity with water requires many of its production steps to take place in a highly controlled atmosphere, making the process more costly and complicated. As a water-based battery, zinc-ion does not have this constraint. In the short term, zinc ion’s key differentiators from lithium-ion are safety and supply chain security. Due to its use of water as the electrolyte, Zinc-ion’s intrinsic safety will gain traction in markets where lithium-ion adoption has been limited due to safety concerns. (Power Magazine)

As investors see, the growth of supply for needed Zinc production is paramount. Tinka is in the middle of this growth and should be considered a proxy. There are opinions stating that eventually, zinc-ion batteries could well be the choice over lithium-ion.

Bottom Line:

Tinka is smack dab in the middle of the action within Peru’s major global Zinc area. The projected stats are impressive, and the potential appears to equal a very compelling opportunity. A list of inferred resources of et al. in the Ayawilca sort as;

- Zinc – 3.0 billion pounds in the Indicated resource category and 5.7 billion pounds inferred

- Silver – 10.3 million ounces in the Indicated resource category and 30.7 million ounces inferred

- Lead – 87 million pounds in the Indicated resource category and 370 million pounds inferred

For Tinka’s part, its property breakdown is available (scroll down) here. Tinka has progressed to a point and in the area where a hard look at the Company as a critical, short-supply metal is warranted.

Also, have a look at Tinka’s other impressive properties.

Posted on behalf on Tinka