Pegasus Resources Inc. (TSX-V: PEGA) is a diversified Junior Canadian Mineral Exploration Company focusing on uranium, gold and base metal properties in North America.

The Athabasca Basin is a region in the Canadian Shield of northern Saskatchewan and Alberta, Canada. It is best known as the world’s leading source of high-grade uranium and currently supplies about 20% of the world’s uranium.[1]

Pegasus has well represented in NE Athabasca Basin in Saskatchewan, with a resource estimate of over 200k tons which means about 535k pounds of uranium. Within the basin, PEGA holds:

- Wollaston Northeast: 7 claims, 34,721 ha

- Bentley Lake: 3 claims, 12,397 ha

- Mozzie Lake: 3 claims, 6,908 ha

- Pine Channel: 1 claim

Recent Doings

Leaving all the mining jargon for another time, PEGA “ has commenced an application for exploration permits and mobilization of a crew on the Chord Uranium Project located approximately 5.5 kilometres southwest of the enCore Energy Corp., licensed Dewey–Burdock ISR Uranium deposit. Union Carbide delineated (historical, non-43-101 compliant) two unoxidized deposits (October Jinx and Viking) that are 350 ft. to 500 ft. deep.

Underground Mining Resources (historical, non-43-101 compliant)

| Mine Unit | Tons | %U3O8 | Lbs. U3O8 | |

| October Jinx | Measured | 615,700 | 0.133 | 1,187,400 |

| Indicated | 218,000 | 0.133 | 453,000 | |

| Viking | Measured | 166,000 | 0.101 | 336,000 |

| Total (M+I) Resources (Lbs. U3O8) | 1,977,000 |

Open Pit Mining Resources (historical, non-43-101 compliant)

| Mine Units Combined | Tons | %U3O8 | Lbs. U3O8 |

| Long Mountain (6 units) | 323,800 | 0.062 | 402,990 |

| Fox River (2 units) | |||

| Total Measured Resource (Lbs. U3O8) | 402,990 |

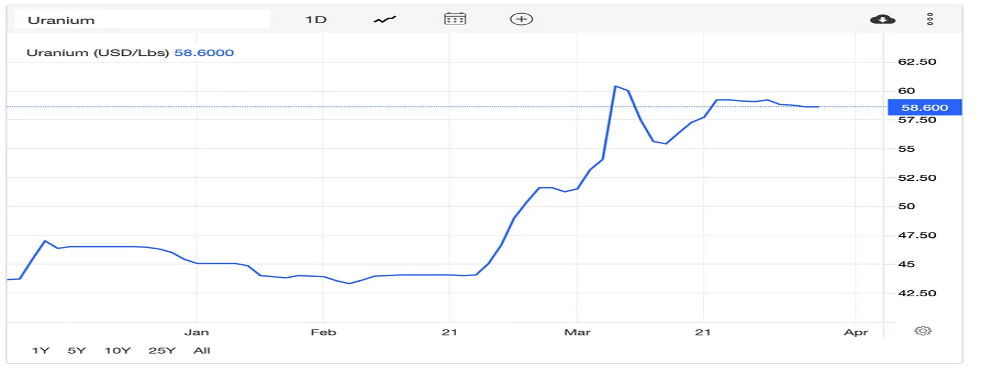

Supply/Demand Outlook

Current Demand: About 440 reactors with a combined capacity of about 390 GWe require some 74,000 tonnes of uranium oxide concentrate containing about 62,500 tonnes of uranium (U) from mines (or the equivalent from stockpiles or secondary sources) each year.

Current Supply: Mines in 2020 supplied some 56,287 tonnes of uranium oxide concentrate (U3O8), containing 47,731 to 74% of the utilities’ annual requirements ( World Uranium Mining).

The IEA World Energy Outlook predicts a 52% increase in electricity demand from 2020 to 2040, with a 75% increase predicted from 2020 to 2050.

There is increasing recognition that nuclear power, with its clean emissions profile, reliable and secure baseload characteristics and low, Levelized cost, has a vital role in achieving decarbonization goals. (Cameco.com)

This factoid is fascinating, also from Cameco;

Utility customers do not come to the market right before they need to load uranium into their reactors. To operate a reactor that could run for more than 60 years, natural uranium and the downstream services must be purchased years in advance, allowing time for several processing steps before it arrives at the power plant as a finished fuel bundle.

Of particular interest for investors is the renewed interest in Uranium, which is in no small measure due to recent comments made by billionaires such as Elon Musk and the investment activities of others in next-generation nuclear power, such as Bill Gates. Musk twittered the critical nature of nuclear to national security, and Gates, Bezos et al. have invested in next-generation atomic startups.

Pegasus CEO and President Charles Desjardin stated, “We feel the global uranium market should continue to build strength as the push for green energy alternatives accelerate. As we build our diversified uranium portfolio, we continue evaluating uranium assets in Canada and the United States. Given the current geopolitical climate, uranium demand should continue to accelerate.”

Pegasus is a developing story with good properties in an age of renewed interest and the need for sustainable electricity generation. Nuclear’s time has likely come, and the Company as the new kid on the block finds itself betwixt and between. Previous work has shown the potential in a premier U308 area.

Bottom Line

War in Ukraine and ramped-up global warming/climate concerns make a case for owning modest –for now–PEGA—at a CDN$0.06 and market cap of CDN$5.42 million, potential growth or perhaps takeover candidate.

It seems Pegasus is in a suitable political climate and has properties in a skookum area, globally speaking.

Posted on Behalf Of Pegasus Resources