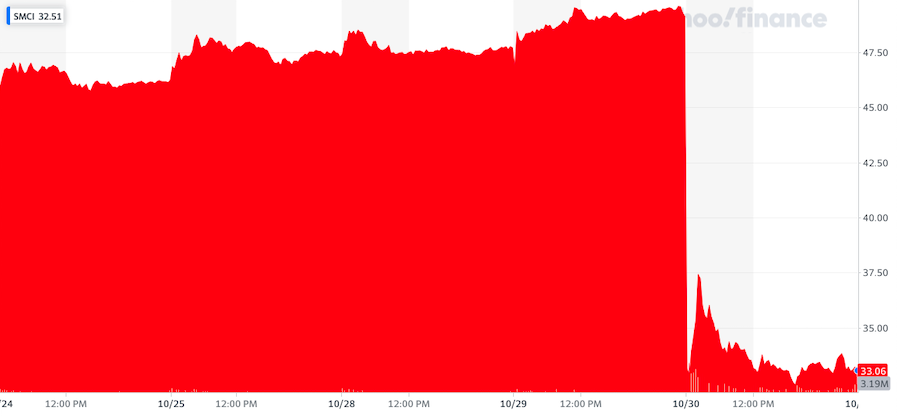

Today, Super Micro Computer experienced a striking 32% drop at market opening following Ernst & Young’s resignation as its auditor. The company has faced significant scrutiny, with previous allegations from Hindenburg Research accusing it of accounting manipulation and various management issues. Amid these ongoing controversies, potential investors may reasonably question the stability of investing in SMCI.

Supermicro has faced recent challenges. In August, Hindenburg Research issued a report alleging issues within the company, and shortly after, the Wall Street Journal reported a possible Justice Department investigation. Additionally, Supermicro delayed filing its annual report (10-K), raising investor concerns over earnings.

The company refuted Hindenburg’s claims, stating its delayed 10-K report wouldn’t impact earnings significantly, though it didn’t comment on the WSJ report. While Supermicro’s stock initially dropped by 29%, it has since rebounded. Wall Street remains optimistic, with analysts projecting a 60% share price increase in the next year.

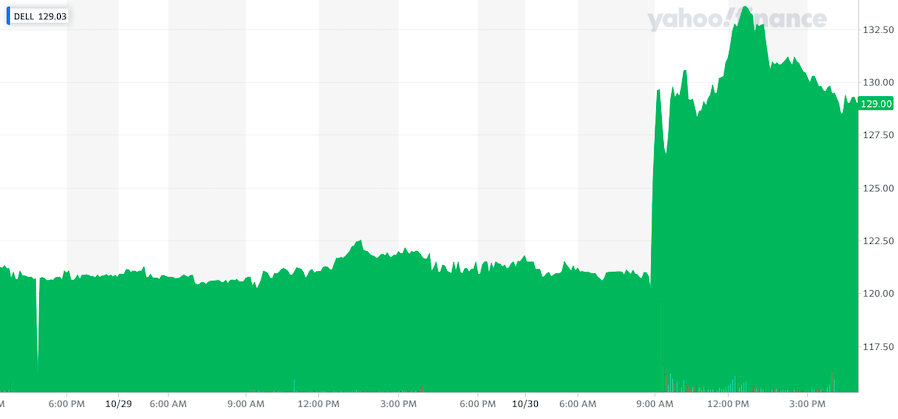

Dell’s stock soared today following the announcement that Super Micro Computer’s (NASDAQ: SMCI) financial auditor had resigned. Both companies are major players in the AI server market, and Supermicro’s recent challenges appeared to create potential openings for Dell.

Dell Rises as Super Micro Computer Shows Signs of Instability

Earlier, Super Micro Computer submitted a filing with the SEC, revealing that Ernst & Young had resigned as its financial auditor. In its resignation letter, Ernst & Young stated that “recently acquired information” made it unable to continue relying on representations from Supermicro’s management and audit committee. This disclosure marked another significant blow for Supermicro’s stock, which closed 72% lower than its high in March. With mounting skepticism surrounding Supermicro, investors turned increasingly bullish on Dell.

What Did Supermicro’s Setbacks Mean for Dell?

While Supermicro’s issues didn’t directly alter its products’ competitive standing, the turbulence seemed likely to work in Dell’s favor. The possibility of customer shifts to Dell grew if Supermicro became mired in further scandal. Additionally, as the AI server market continues expanding, investors began viewing Dell as a more stable and attractive opportunity.

Supermicro faced the risk of delisting from the Nasdaq if it couldn’t secure a new auditor to complete its delayed 10-K filing. Should this delisting occur, analysts predicted that a large outflow from Supermicro stock could result, with Dell potentially receiving some of that redirected investor support.

Marc has been involved in the Stock Market Media Industry for the last +5 years. After obtaining a college degree in engineering in France, he moved to Canada, where he created Money,eh?, a personal finance website.