Element79 Gold Corp. (CSE: ELEM) (OTC: ELMGF) (FSE: 7YS) is a mining company focused on gold, silver and associated metals and committed to maximizing shareholder value through responsible mining practices and sustainable development of its projects.

The properties are in Ontario, Nevada, and Peru.

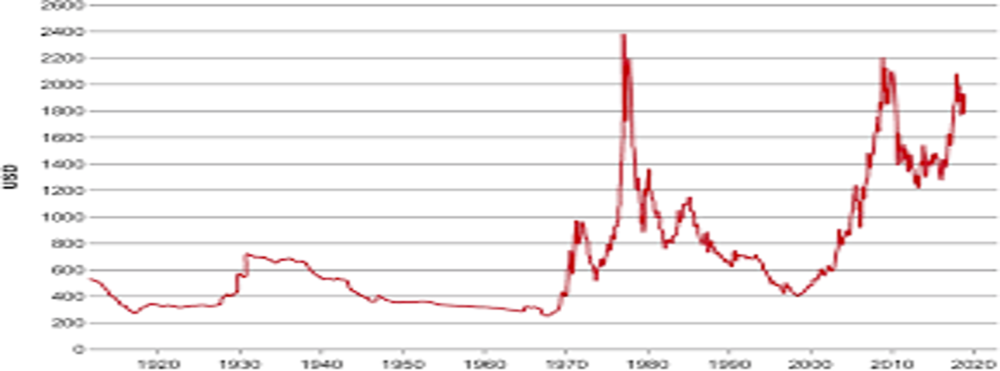

What do the pundits say about gold’s trajectory through 2030? 2050? Given the nature of gold’s volatility, the bias is up. In several cases, way up.

Peter Krauth, well known for his work on gold and silver, is one of the positive voices. In his book, Krauth has a model which forecasts that gold’s price will rise to $5,000 by 2030.

Krauth states; “”I’m not the only one who thinks that gold will go to $5,000 or even perhaps $10,000 in a speculative mania,” he explained. “You’ve got people like Jim Rickards, Shayne Maguire, who ran a gold fund for the Texas teacher’s retirement system, and Scott Minerd of Guggenheim.”

The latest Kitco Wall Street gold survey shows 53% of respondents were bullish, 7% bearish and 40% neutral.

The point is not to pinpoint gold’s forecast price but to accept that gold exposure should be in every portfolio.

Expose yourself to non-physical gold.

Indeed, if one wants to own some shiny gold bars, coins, and wafers, from a liquidity point, physical ownership basically sucks.

How would you sell physicals quickly if you owned some and needed the money quickly? It makes more sense to buy shares. Risk-averse investors may look hard at gold ETFs: A Gold ETF is an exchange-traded fund (ETF) that aims to track the domestic physical gold price. They are passive investment instruments based on gold prices and investing in gold bullion.

Some senior gold companies might suit those with a bit higher risk tolerance.

Due to the inherent leverage, the best potential reward comes from junior gold stocks. Note I said potential. The risk is significant, and the Company needs experienced management and good mining properties with the potential to increase production or bring new mines online. Also, it can take years.

That said, an ounce of physical gold is roughly USD1950. A quality junior such as ELEM trades at Cdn0.05 a share. If gold rises by 50 percent, the return on ELEM will likely be significantly better (and more liquid) than physical. Probably more than 100 %, and I believe that figure is conservative.

Element 79, My Dear Investor.

Here is the Corporate Presentation.

Investors should be keen on ELEM as it is not a ‘we have a drill on the property’ kind of investment. Position, deal-making, and gold exploration and mining make this an investment with legs. I recommend you access and digest the management team‘s experience and contacts put ELEM in the top strata of junior golds.

There are a lot of cold companies out there. Few have the potential of Element 79.

Unlike many of its peers, the Company has announced a clear corporate growth path through 2023 and beyond. The Company also directly addresses the focus on critical properties, enforcing that spinning off extra land packages around its Maverick property is a priority.

| Mine | Major owner/operator | 2020 Au output, Koz | |

| 1 | Carlin Trend | Barrick | 1,665 |

| 2 | Cortez | Barrick | 799 |

| 3 | Turquoise Ridge | Barrick | 537 |

| 4 | Round Mountain | Kinross | 324 |

| 5 | Cripple Creek and Victor | Newmont | 272 |

| 6 | Long Canyon | Barrick | 261 |

| 7 | Fort Knox | Kinross | 238 |

| 8 | Marigold | SSR Mining | 234 |

| 9 | Phoenix | Barrick | 205 |

| 10 | Bald Mountain | Kinross | 191 |

As a gold investor, unless you have been living under a non-gold-bearing rock, the corporate names in the above chart should grab your attention: as should the Carlin and Battle Mountain trends.

The Peru properties bear revisiting:

Many of ELEM’s closed or contemplated deals include value paid to the Company and participation in the deal lands included. ELEM’s Lucero property holds 11,000 hectares in the Chila range in southern Peru. A recent NI 43-101 report has been. Samples collected by the Qualified Person (the “QP”) returned up to 116.8 g/t Au Eq (78.7g/t Au and 2,856 g/t Ag). Prospecting by previous operator Condor Resources Inc. (“Condor”) from 2012 to 2020 identified the high-sulphidation epithermal alteration zone with structures that returned peak sample values of 80.1 g/t Au Eq (33.4 g/t Au and 3,500 g/t Ag).

On the risk pyramid, junior stocks such as ELEM are at the pointy part. It does, however bring you excellent potential through great management. It also gets you liquidity and risk mitigation through an aggressive deal program, gaining, in most cases, cash and meaningful, but risk reduced ongoing participation.

I own some. You should too.

Posted on Behalf of Element79