Pegasus Resources Inc. (TSX-V: PEGA) is a diversified Junior Canadian Mineral Exploration Company focusing on North America’s uranium, gold and base metal properties.

The Athabasca Basin is a region in the Canadian Shield of northern Saskatchewan and Alberta, Canada. It is best known as the world’s leading source of high-grade uranium, and the area currently supplies about 20% of the world’s uranium.

PEGASUS as proxy for the ongoing volatility in the Uranium market

Pegasus has well represented in NE Athabasca Basin in Saskatchewan, with a resource estimate of over 200k tons which means about 535k pounds of uranium. Within the basin, PEGA holds:

• Wollaston Northeast: 7 claims, 34,721 ha

• Bentley Lake: 3 claims, 12,397 ha

• Mozzie Lake: 3 claims, 6,908 ha

• Pine Channel: 1 claim

The IEA World Energy Outlook predicts a 52% increase in electricity demand from 2020 to 2040, with a 75% increase predicted from 2020 to 2050.

An odd, yet bullish turn for uranium

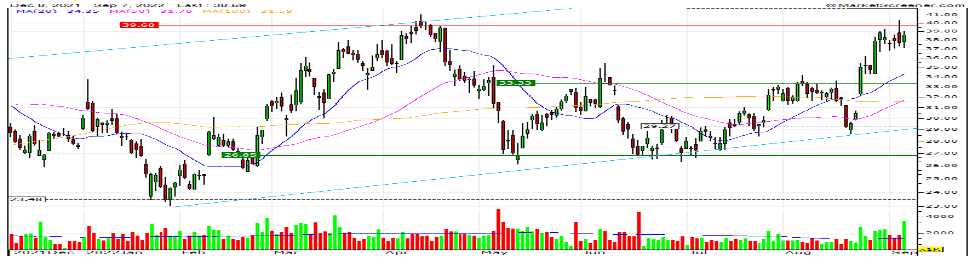

Giant Cameco Corporation (CCJ) recently had a very large number of call options purchased that are out-of-the-money. This activity indicates an investor or group of investors are very bullish on the uranium mining company’s prospects. Investors may end up jumping on the bandwagon, even though the stock is already up over 15% in the last month.

As investors can see, the shares popped on significant volume over the last few days. Technically, the purchase of large numbers of out-of-the-money call options in major uranium shares of Cameco (CCJ) over the last few days, which has fueled a run in the sector.

Cameco Chart

Out of the money call options are purchased to potentially take leveraged advantage of a large perceived price rise.

The first tranche for 22,667 (call options) would have cost $3.173 million (i.e., 22,667 calls x $1.40 x 100), which is 224 times the regular open interest (amount of contracts normally held). The investor(s) was willing to pay this with the assumption that CCJ stock will keep rising quite significantly over the next 3 months. The strike price at $37.00 is 28.38% over today’s price. So the investors put up a substantial sum believing CCJ will move up 29% by Dec. 16.

The second tranche has a lower hurdle. The investor(s) believe the stock will rise over 7.6% from today to $31.00 per share. They likely paid $6.83 million for 22,774 call options at the $3.00 mid-price for the options. This resulted in 62 times the normal open interest in the stock. (Barchart)

Uranium has had a lot of ink lately as energy supply/demand roils. With situation in Europe as Russia threatens energy supply to Europe and other aggressions, the world is becoming more comfortable with Nuclear Energy as a clean and affordable power source, albeit years away.

That said, Bill Gates has been busy developing state-of-the-art and safe nuclear power. He is ready to build his first facility.

• Bill Gates’ TerraPower has chosen Kemmerer, Wyoming, a frontier-era coal town, as the site where the company will build its first demonstration nuclear power plant.

• The plant will cost about $4 billion, half coming from TerraPower and half coming from the United States government, the company said.

• Will operate the plant, which will play a role in the power company’s decarbonization strategy.

Rocky Mountain Power — a PacifiCorp division owned by Berkshire Hathaway Energy — Once built, the plant will provide a baseload of 345 megawatts, with the potential to expand its capacity to 500 megawatts.

Other Developments:

PEGA Article Notes

– Trading Volumes Up Over 1 million shares

– Japan & USA doubling down on nuclear

– Energy Prices up 400% in Europe

– Ready to start drilling (major catalyst)

PEGA is undoubtedly a low cost way to gain exposure to both Uranium, the Athabasca Basin and in the same breath as major producers. Investors by their purchases are showing the Company to be involved and a potential major growth vehicle going forward in the volatile energy debate.

Watching the shares is recommended. For risk oriented investors interested in the sector, a purchase should be contemplated.

Other Articles Supporting Nuclear

Why even environmentalists are supporting nuclear power today

https://www.npr.org/2022/08/30/1119904819/nuclear-power-environmentalists-california-germany-japan

Japan Restarting

Germany Keeping Nuclear Power

France Restarting Entire Nuclear Fleet

Sentiment Changing

Bob Beaty

For over 30 years, Bob Beaty has been explaining concepts and companies to the global investment community. One of the original writers for Jim Cramer’s Thestreet.com, he also wrote for AOL (Can/US), the Globe and Mail, and the Huffington Post. Over that period, he illuminated small-cap companies to investors with wit and pith but mostly opinion and facts. Investing should be fun. Pedantic, staid content is no fun.

Before embarking on his writing career, Bob had a successful international journey in the finance industry. He served as a broker, derivatives product manager, and a Director of London's Credit Suisse subsidiary. His career spanned across major financial hubs including Toronto, Vancouver, and the UK, giving him a unique global perspective. (He is still fondly remembering those English client lunches.)

Other than everything Groucho Marx and George Carlin ever said, Bob lives by a simple credo;

‘Never do anything the person standing in front of you can't understand.’ Hunter S. Thompson.

Let’s go.

All Articles

The latest

An Undervalued Biotech Showing Promise

5 Uranium Stocks to Look After in November

Subscribe

©2024 10xAlerts