With World-Class Gold Assets in Nevada, Near-Term Production in Peru, and Large Tier-1 Resource, the All-Star Team Leading the Way for Element79 Gold Corp.

(CSE: ELEM) (OTC: ELMGF) are Building Toward THE Quintessential Gold Story of 2023

Let’s be honest, the market’s reaction to the gold mining sector isn’t exactly setting the world on fire in 2023. But for those in the know, who still know what to look for, it still holds PLENTY of potential for investors willing to do their homework.

If you think that gold isn’t about to get red hot, several analysts would disagree with you!

At the beginning of the year, gold surged to 6-month high, leading analysts to expect records in 2023, in particular central bank moves that will “ignite an explosive move for gold for years to come.”

In fact, just prior to these predictions at the end of December 2022, other analysts were predicting that gold prices could even surge to $4,000 an ounce in 2023.

Meanwhile, market professionals are predicting that junior gold stocks are poised to outperform in 2023.

But when it comes to junior miners, it’s crucial to sift and separate the gold nuggets from the fool’s gold.

Element79 Gold Corp. (CSE: ELEM) (OTC: ELMGF) has strategically assembled a portfolio of 100% interest properties in both Nevada and in Peru, one with a significant Tier-1 level inferred resource in a Tier-1 jurisdiction, and the other with near-term production in place. More importantly, the company is led by some of the best minds in mining today, with production experience with some of the biggest mining companies in the world, and having been to the dance more than once to bring a dream to production.

There are several factors to consider when evaluating juniors, and Element79 Gold checks ALL the boxes.

World-class properties? CHECK

All-Star team with production experience? CHECK

Foreseeable production with near-term cash flow? CHECK

For those who have won big at this game before, this vetting process is not only fun, but actually easy when the right signs present themselves as clearly as they do with Element79 Gold.

First and foremost, you want a company with a real, substantial gold deposit. Quality and quantity! That’s what will give you the best chance of a return on your investment.

Next, you want to see some signs of near-term cash flow. Whether it’s through production or a smart asset sale, you want to know that your investment won’t be tied up for eternity.

The management team is also crucial. You want a group of gold diggers with a proven track record of success, who have experience in all aspects of the gold game.

After all, you don’t want to be stuck in a gold rush led by a bunch of rookies, do you? When things get going, you don’t want to rely on a team that’s fishing out their university textbooks to see what comes next in the process.

And last but certainly not least, the company should have the financial resources to support their golden dreams. A solid war chest will ensure they can weather any storm and bring their project to fruition.

Now let’s get to the meat and potatoes and take a deeper look into why Element79 Gold Corp.(CSE:ELEM) (OTC:ELMGF) is built to win in this upcoming gold rush, with the right property, the right team, and the right business plan to succeed.

7 Reasons Investors Need to Pay Attention to Element79 Gold Corp. (CSE:ELEM) (OTC:ELMGF)

Near-Term Production and Cash Flow: Through Peruvian ore extraction from a previously producing mine at its Lucero property, Element79 Gold has strategically positioned itself with a unique opportunity for near-term cash flow, which quickly puts the company into a position to move forward more smoothly. The property is already permitted for 350 td production, and has already produced at solid rates in the past and is seeing production today through artisanal local miners who will be enlisted to carry out production capabilities on the property and likely move ore to local mills for production and quick and easy cashflow to support other operations.

All-Star Team: The team assembled behind Element79 Gold is extraordinary, in that it brings to the table multiple mining experts with experience in finding, developing, and operating mines. Their pedigree is Top-Tier, with multiple CVs that include senior level positions with respectable industry players such as Barrick Gold, Skeena Resources, Freeport-McMoran, Eidorado Gold, Koch Industries, MMG, McEwen Mining, Rio Tinto, Kaunis Iron, KGHM, NOVAGOLD and more. These aren’t inexperienced hands at the wheel who have to dig out their university textbooks to see what comes next. These are minds that have seen projects all the way through the cycle, and are primed to do it again with Element79 Gold.

3 Tier-1 Resource: With 3.71M ounces of gold equivalent (Au Eq) Inferred on the Maverick Springs property, Element79 Gold has the ability to upgrade the standing of many ounces with modern drilling and exploration methods, having already made a significant upgrade constraining those ounces within a conceptual pit over its previous unconstrained historic resource estimate.

4 Spin-Out Opportunities: The company has 17 projects in Nevada and Canada for Spin-Outs, JVs and sale. Element79 Gold is currently making progress toward closing the sale of its Long Peak, Stargo, Elder Creek, North Mill Creek, and Elephant projects in Nevada.

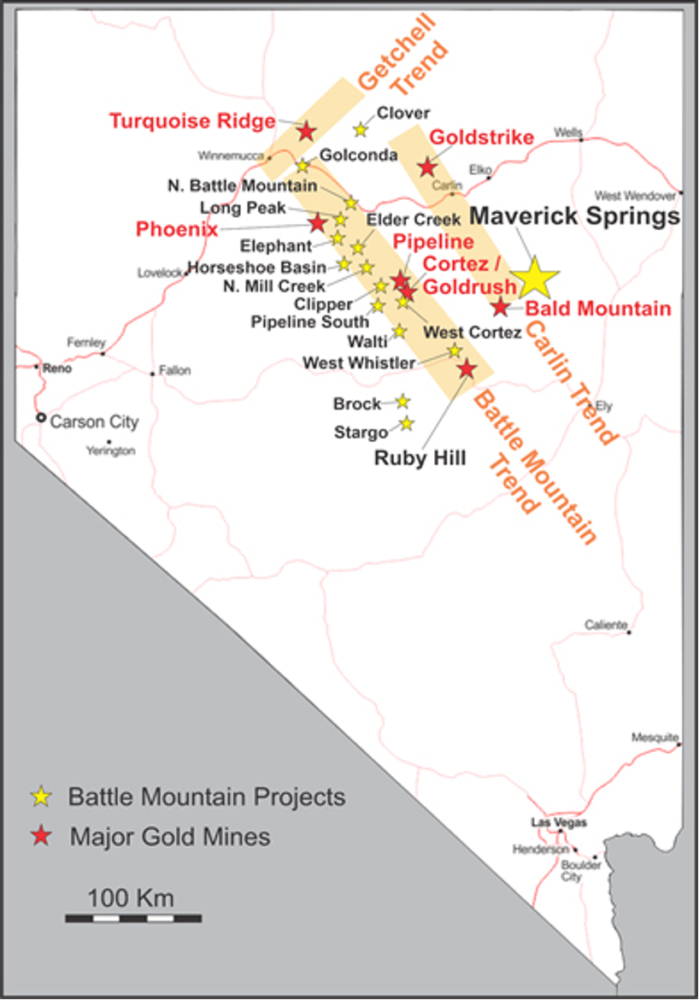

5 Closeology: At its Maverick Springs project in Nevada, Element79 Gold is triangulated by three other properties, including two producing mines at the Pan Gold Mine from Fiore Gold, and the Bald Mountain Mine of Kinross Gold. As well, the project is in very close proximity with similar geology to the prolific Carlin Trend, known as the most productive gold trend in the United States.

6 Jurisdictional Diversification: With assets spread across Nevada, Canada, and Peru, Element79 Gold has a balanced portfolio of varying grades and risks. Nevada is consistently ranked in the Top 10 by the Fraser Institute’s Annual Survey of Mining Companies for Investment Attractiveness, (ranked #3 in 2021). Their other properties were also in respectable jurisdictions finishing in the World’s Top 50, with Ontario (#12), British Columbia (#16), and Peru (#42). In terms of Policy Perception Index, the jurisdictions also place respectably with Nevada (#6), Ontario (#17), British Columbia (#28), and Peru (#69) respectively.

7 Tidy Share Structure: Because of its potential near-term ability to generate cashflow from its Peruvian assets, the risk of watering down the stock is greatly reduced. Getting to this point, the company has kept its share structure relatively tidy, with only -83M shares outstanding, of which Management and Board hold about 10-12%, the Mine Plus Group holds 6%, and just under 14% is held by funds.

Maverick Springs Tier-1 Project: The Flagship Asset

Designated firmly as its flagship asset, Element79 Gold Corp. (CSE: ELEM) (OTC: ELMGF) has a lot to work with at its Maverick Springs Tier 1 Project, which comes with an Inferred Resource of 3.71 million ounces Au EQ (gold equivalent ounces; a combination of 1.37MMoz Au and 278MMoz Ag).

Upon first glance, a gold bug can see what appears to be a decently significant resource in place, but where Element79 comes in to spruce things up, is in how it’s reimagined the project from the moment it acquired it. This project has not seen any exploration in 14 years!

The flagship Maverick Springs Project consists of approximately 4,800 acres across 247 unpatented claims that straddle the borders of Elk and White Pine County, proximal to the Carlin Trend.

It’s accessible year-round via gravel road, with a network of drill roads spread throughout its claims. Nearby electrical power can be sourced from the eastern Nevada grid system to the northwest.

If you’re not already familiar with the Carlin Trend, this one is a biggie. This belt of gold deposits is approximately 5 miles wide and 40 miles long, making it one of the world’s richest gold mining districts-having produced more gold than any other mining district in the USA.

Element79 Gold’s Nevada Closeology

Now that we know WHERE the Maverick Springs Project is located, it’s worth taking a deeper look at what’s around it.

Looking at the map, Element79 Gold has its flagship asset triangulated in good company, with three properties in close vicinity:

- Bald Mountain Mine – Kinross Gold (NYSE: KGC) (TSX: K)

- Open Pit – Heap Leach

- Reserves: 798,00 ounces as of Dec 31, 2021

- Resource: Approx. 3.6 million oz Au (M+|)

- 204,890 oz Au Eq – 2021 production

- 28km away

- Pan Gold Mine – Fiore Gold

- Reserve: 290,500 oz Au (P+P)

- Resource: 427,000 ounces (M+|)

- +45,000ounces produced in 2020

- 18km away

- Medicine Springs – Reyna Silver Corp. (TSXV: RSLV) (OTC:RSNVF)

- 20km away

- Historic drilling defined a small, possibly stratabound, resource (350,000 tons of oxides mineralization averaging a grade of 2.3 oz/ton Ag)

Just raised $4.9M for the expansion of this early-stage project!

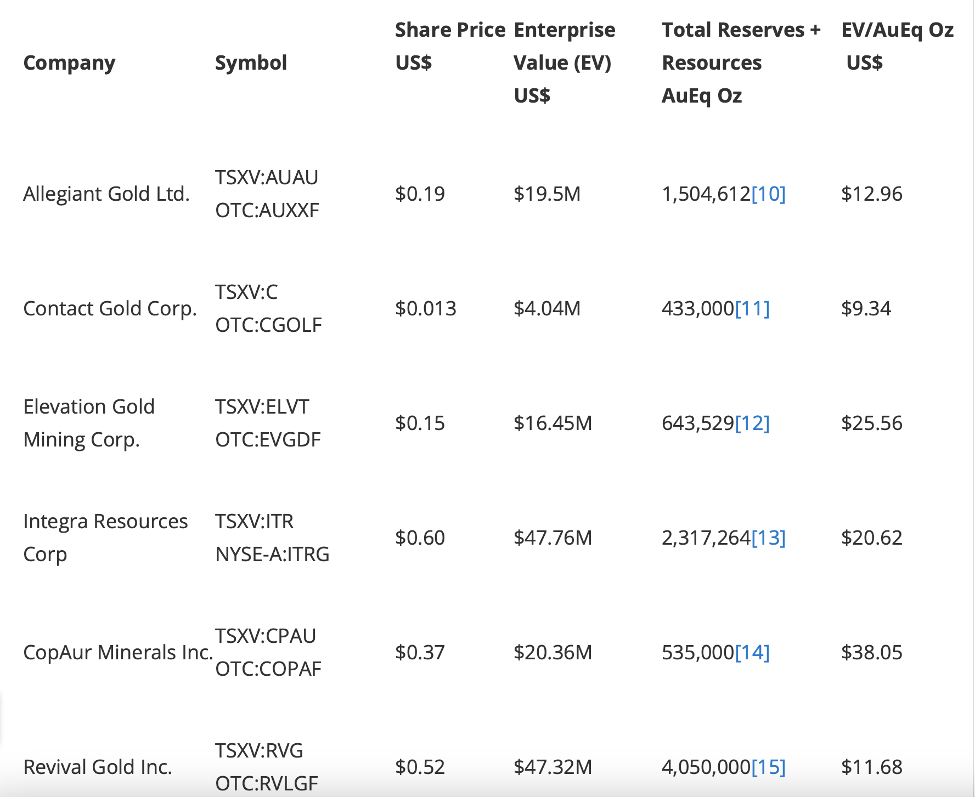

Value Given for Ounces in the Ground

Now, when someone begins to poke around and kick tires on a company to see if they’re undervalued somewhere, a good place to start is to see what the market is giving a company for each gram of gold in the ground.

In the case of Element79 Gold Corp. (CSE: ELEM) (OTC: ELMG) it’s pretty apparent that this might be one of the cheapest grams of gold you’ll find anywhere on Earth.

With its Inferred Resource of 3.71 million ounces of Au Eq, that’s roughly $2.05 per ounce of gold in the ground.

Now the market awaits the results of every action Element 79 Gold takes to improve the value of each of its 100% interest properties.

As an exploration company, Element79 Gold currently can’t be valued based on revenues, EBITDA, earnings, or cash flow. Other analysts have employed an Enterprise Value/Resources method for their valuations on the company, which are broken down as follows:

Based on Element79 Gold’s 100% interest in the Maverick Springs NI 43-101 compliant inferred resource of 3.71 million gold equivalent ounces, enterprise value per gold equivalent ounce is below the comparable group average of C$18.47 or US$13.85.

Let’s now take a look at the company that Element 79 Gold is working towards competing within its peer group in Peru and Nevada.

As Element79 Gold Corp. (CSE: ELEM) (OTC: ELMG) advances toward a preliminary economic assessment (PEA), it will likely begin to trade closer to the comparable group average on a gold equivalent ounce basis.

Additionally, further upside exists if the company can expand its Maverick Springs asset’s mineral resources, and continue to option, joint venture, or sell projects within the Battle Mountain portfolio.

If Element79 Gold’s interest in Maverick Springs was instead valued at the comparable group average of US$13.85 per gold equivalent ounce, near-term fair value for the project would be worth at least US$51.4 million.

Then just taking the purchase price for the Peruvian assets which were US$15.0 million, adding back cash and subtracting debt would return a value of closer to US$66 million-or nearly 770% higher than it is valued by the market at this time.

That’s what we’re looking at in the current picture on Element79 Gold Corp. (CSE: ELEM) (OTC: ELMGF).

Cashflow from Peru

In June 2022, Element79 Gold Corp. (CSE: ELEM) (OTC: ELMGF) made a monumental acquisition when it picked up two Peruvian properties, including the past-producing Lucero Mine-one of the highest-grade underground mines in Peru’s history.

The Lucero Mine is legendary, with averaged historical grades of 19 g/t Au Eq, from 14 g/t Au and 450 g/t Ag.

Both projects acquired in the purchase of Calipuy Resources are permitted for up to 350 tones per day of high-grade ore extraction. Element79 Gold has gone out of its way to establish and increase its favorable social engagements with locals as well as local mills with accessible capacity.

Moving forward, the Element79 Gold strategy is two-fold:

FIRST, Element79 Gold is set on carrying out exploration and developing a mine plan, to review previous workings and to explore identified surface and underground veins, all in an effort to bring previous work on site to modern NI 43-101 standards, and provide confidence in a mine with a targeted 5-10 year life of mine based on all historical work in place.

SECOND, the company will then leverage regional infrastructure for commercial off-take, while sustainably extracting an average of 150 tonnes per day of high-grade ore to generate non-dilutive cash flow to further fund corporate operations and exploration initiatives across Element79 Gold’s portfolio of projects.

In the world of mining to secure a cashflow THIS early on in the company’s story arc is almost unheard of.

It can’t be emphasized enough how much of an advantage this will be for Element79 Gold Corp.(CSE:ELEM) (OTC:ELMGF), once they’re receiving payments for gold sales from Peru.

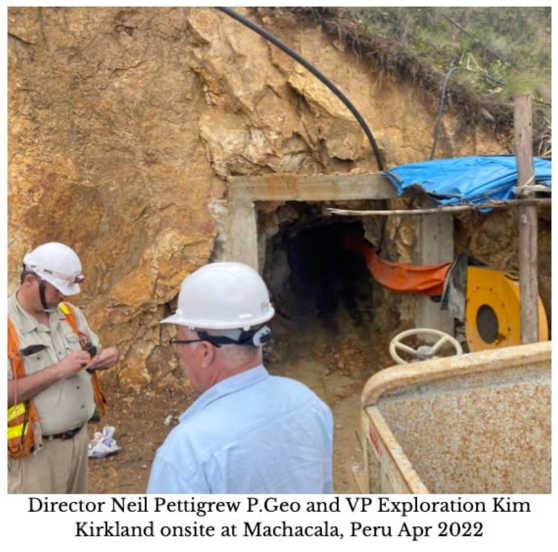

And they have the team to do it, as the acquisition came with the addition of strong mining minds, who have experience with production in Peru, including Kim Kirkland… who will be discussed in the next section.

World Class Mining Team Tying It Together

When it comes to mining, the ones steering the ship can make or break a journey, and in the case of Element79 Gold Corp. (CSE:ELEM) (OTC:ELMGF) we’re looking at a World Class Team that not only has experiencing making discoveries, but also seeing them through to production, and operating mines. The team includes:

James C. Tworek – CEO: With 25 years of experience in finance, Twork has a rich background in the industry. He began his career in commercial banking in 1998 and later, in 2005, he joined a brokerage firm as a partner, where he was involved in an in-house mezzanine development fund for 7.5 years. Additionally, Tworek runs a Corporate Finance Consulting firm, serving clients such as Funds, Family Offices, Private Equity, and Venture Capital.

Since 2018, he’s been serving in several Independent Director and Special Committee positions for publicly traded companies in the Canadian markets. He currently acts as an Advisor to the Board of Muzhu Mining (CSE:MUZU), and is a Director at Florence One Capital (TSX:FONC).

Antonios (Tony) Maragakis, PhD, MSc. – COO, Director: Maragakis boasts an impressive resume, having held several management and director-level positions overseeing multi-billion dollar project portfolios on a global scale. He was at the helm of projects in North America while working at Barrick Gold (NYSE:GOLD) (TSX:ABX) leading a portfolio of over 70 projects worth more than $2.3 billion. At Skeena Resources (NYSE:SKE) (TSX:SKE), Tony collaborated with the executive leadership team to develop the Eskay Creek Project. He was also part of the team at Freeport-McMoRan (NYSE:FCX) that developed the $3 billion Indonesian Copper Smelter Project. While at Eldorado Gold (TSXELD), Tony served as Project Director for the $1 billion Skouries Project and led the operational turnaround of the Kassandra Mines. Lastly, at Koch Industries (the 2nd largest privately held company in the USA), he helped execute the Enid Expansion Megaproject.

Kim M. Kirkland – VP Global Exploration: Kirkland is a seasoned executive with extensive experience in the mining industry, specifically in Nevada and Peru. Throughout his career, he has held senior executive and lead engineering positions at some of the world’s largest mining companies. At Barrick Gold, he was involved during the early growth and innovation years at the Goldstrike Complex, where he was responsible for the development and maintenance of the open-pit mineral reserve model for the Betze-Post Mine. He held a senior management position at the Benga Mine while at the Rio Tinto Group for the La Granja Copper Project in northern Peru. As Regional Manager at the Las Bambas Copper Mine in Peru for MMG, Kim was responsible for overseeing the day-to-day operations. At Amec Foster Wheeler Plc, he was part of the team managing the Marcobre S.A.C.’s Mina Just Mine Project. While at McEwen Mining (NYSE:MUX) (TSX:MUX), he was responsible for the restructuring of the El Gallo Silver Project (later renamed to Fenix) in Sinaloa, Mexico, as the Director of Project Development.

Neill Pettigrew MSc., P.Geo – Director: Pettigrew is a highly experienced and well-respected professional geologist who has spent over two decades working in the mineral exploration industry.

Throughout his career, he’s served in both senior and director-level positions at several junior and major companies in the gold and Cu-Ni-PGE exploration industries. He’s held key positions at TX and TSX-V listed junior companies and currently serves as Vice President Exploration and a director of Palladium One Mining (TSXV:PDM). Before entering the private sector, Neil was a Senior Precambrian Geoscientist with the Ontario Geological Survey.

Shane Williams – Director: Williams has over 20 years of experience in the mining/oil and gas industry specifically related to the development, construction, and operations of large-scale resource projects, and Most recently stepped down from his position as COO at Skeena Resources after three years. Before this Shane has held roles as VP of Operations and Capital Projects at Eldorado Gold (TSX:ELD) for six years. He has extensive open-pit development experience from his time working with Rio Tinto (NYSE:RIO) at the Iron Ore Company of Canada and at Kaunis Iron in Northern Sweden where he was Project Director.

BONUS! Gold Assets for Spin-Outs, JVs, Sales

Beyond its Maverick Springs and Lucero properties, Element79 Gold Corp. (SE:ELEM) (OTC:ELMG) has also amassed a portfolio of 18 other respectable projects in Nevada and Canada that are primed for spin-outs, JVs and outright sales.

This includes 15 properties along the Getchell and Battle Mountain trends, with several already having more than 100 holes drilled on them which merit development, exploration, and have near-term potential for obtaining resource reports. In fact, the Battle Mountain Portfolio is one of the largest mineral land packages in Nevada with over 2,000 patented claims, surrounded by Nevada’s biggest producing mines.

Substantial historic drilling (NOTE: Not NI 43-101 compliant) has been completed with some significant results at some of the projects, including:

- Elder Creek – 155 holes, up to 3.19 g/t Au over 38.96m

- Clover – 104 holes, up to 25.3 g/t Au over 9.75m

- Long Peak – up to 8.02 g/t Au and 174 g/t Ag over 9.14m

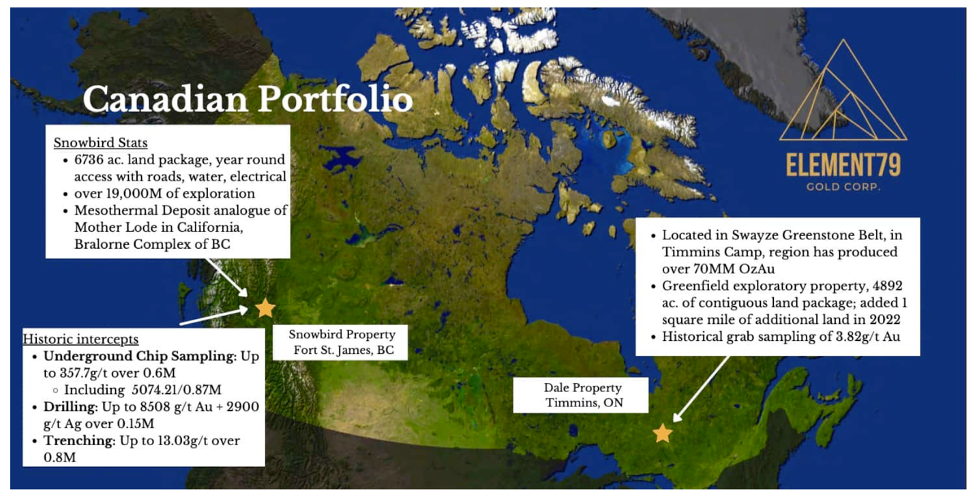

In British Columbia, Element79 Gold also has the Snowbird High-Grade Gold Project, located just 20km west of Fort St. James, which is an analogue to the Mother Lode district in California, and the Bralorne district, which comes with the potential to become a multi-million-ounce resource.

In Ontario, Element79 Gold has an option to acquire 100% interest in the greenfield Dale Property, which consists of 90 unpatented mining claims (-4, 100km?) located approximately 100km southwest of Timmins.

Each one of these assets gives Element79 Gold Corp. (CSE:ELEM) (OTC:ELMG) an opportunity to generate capital in the future, should a decision be made to divest, invest, or partner up.

Case in point: Element79 Gold is currently making progress toward closing the sale of its Long Peak, Stargo, Elder Creek, North Mill, and Elephant projects in Nevada.

RECAP: 7 Reasons To Seriously Look Into

Element79 Gold Corp. (CSE:ELEM) (OTC:ELMGF)

TODAY!

- Near-Term Production and Cash Flow

- All-Star Team

- Tier-1 Resource

- Spin-Out Opportunities

- Closeology

- Jurisdictional Diversification

- Tidy Share Structure

BEFORE YOU CLICK AWAY!

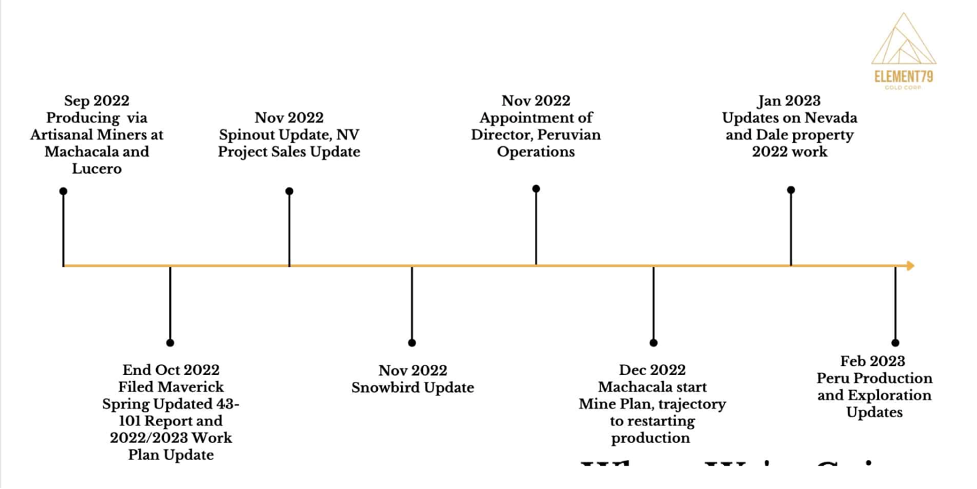

With an exciting Q1 2023 work program already underway, THIS IS THE PERFECT TIME for smart investors to take a more serious look at Element79 Gold Corp. (CSE:ELEM) (OTC:ELMG)-because NOW is the best timing to secure an early-mover advantage!

There are plenty of updates to come on the horizon for Element79 Gold Corp. (CSE:ELEM)(OTC:ELMGF), each of which you’re going to want to get a head start on.So, do your due diligence, and don’t forget to click here to subscribe for email updates and make sure you don’t miss out on any of Element79 Gold’s news and milestones.