NurExone Biologic Inc. (TSXV: NRX), (OTCQB: NRXBF), (Germany: J90) (the “Company” or “NurExone”), a biopharmaceutical company developing exosome-based therapies for the multi-billion dollar regenerative medicine market. Let’s set the background before we build a case for owning NRX.

A stealth market is brewing behind the public markets, which bodes well for the biopharma pubcos.

In 2022, the global biopharmaceuticals market was valued at approximately 263 billion U.S. dollars. According to this estimate, it is expected to increase to around 570 billion U.S. dollars by 2032.

The key emerging industry trends that will shape the future of the biopharmaceutical industry in the coming months are anti-obesity medications, personalized/precision medicine, immuno-oncology drug development, real-world evidence, and cell and gene therapies, among others.

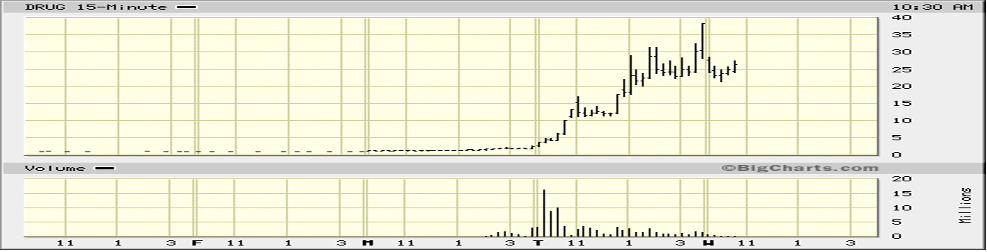

At the moment, Oncology and rare disease therapies, even those in development, are very much on the M&A landscape. As we have seen, the M&A activity has reached a fever pitch in some quarters. I give you the last two days’ trade in Bright Minds (DRUG). I have been in this business for more than a few decades and have never seen this trade activity.

Whether a short squeeze, a takeover run or other activity, a merde-load of cash was made yesterday, Oct 15th; a bet of CDN1000 at the open was worth 10 thousand by the close. Did I own any? Even though I have written a half dozen articles? Of course not. Moron.

M&A activity has increased in private companies, and bio IPOs have slowed.

“Because companies have not gone public, which they might have ordinarily done, there’s actually more of a later-stage pipeline that is still private,” said Naveed Siddiqi, a senior partner at Novo Holdings, the parent company of Novo Nordisk that manages a venture investment portfolio.

As of mid-July, 13 of the 26 acquisitions worth at least $50 million in upfront value this year were of private biotechs, surpassing the pace set in each of the previous six years, according to BioPharma Dive data. In a research note last month, analysts at the investment bank Jefferies noted how the share of buyouts involving startups is by far the highest of any year since 2015.

Look at NRX, a small bio Pubco that checks several boxes. “Globally, an estimated 250,000–500,000 people suffer from spinal cord injuries (SCIs) annually, with 90% of these injuries stemming from traumatic causes such as vehicle accidents, workplace incidents, or sports-related mishaps. In the United States alone, this accounts for approximately 17,000 new cases annually, while in Europe, there are around 10,000 new cases annually. This suggests a potential market for ExoPTEN of approximately 50,000 new cases per year”.

Stole this from the web page as it bears exactitude.

ExoPTEN is NurExone’s first nanodrug. ExoPTEN is being developed for patients who have suffered acute spinal cord injury. It uses exosomes loaded with a specific and proprietary siRNA sequence as the active pharmaceutical ingredient. Studies have demonstrated that ExoPTEN facilitates nerve regeneration, regrowth, and functional recovery following a brief intranasal administration in laboratory animals.

Minimally invasive drug administration

- The natural affinity of exosomes to inflamed or damaged tissue allows minimally invasive and targeted delivery of therapeutic molecules

- Off the shelf

Ease of production, distribution and point of care administration

- Cell-free

No patient personalization and minimal immunogenicity

- Crosses the blood-brain-barrier

While NRX is not public, its potential, you’ll agree, is huge. Therapeutic costs and recovery times would be reduced, and severe pain would be mitigated or removed. You dig into the tech on your own time with a beverage.

The point I am trying to espouse is that NRX represents a potential takeover target, given the size of the spine injury market. Also, low rates make financing a takeover. I am not being definitive, but the theory deserves an airing. Please take a look at the DRUG chart; know that I should have bought some and will likely try to figure out an appropriate penance. I own NRX.

Faites vos jeux.

10xAlerts has been received compensation from the issuer for News Dissemination, Content and Social Media Services.