There are two truths about gold and critical metals investing; no one truly knows or can predict the price level of metals in ten minutes from now or ten years.

That said, and it may seem contradictory, the second fact is that investors need to have gold/and or critical metals representation in their portfolio in one form or another.

Let’s use gold as an example of whether one should own gold but in what form. Proxy representation/exposure is certainly one approach, but any metal position must be highly liquid.

Physical gold is fine, but if you need cash fast, it may be very cumbersome to sell. And if you have gold coins, will you use them to buy groceries, etc? Good luck with that; I am not trying to be facetious, just realistic.

U.S. gold-backed certificates were stopped in 1934 as that country went off the gold standard.

Some banks and investment companies in the U.S. and abroad still issue gold certificates. These generally specify an amount in ounces. Their dollar value fluctuates with the market. That makes them an investment in precious metals rather than an investment in currency.

It is worth noting that this modern trade in gold certificates can be risky. If the company that issues the certificate goes under, the certificate is as worthless as a stock certificate for a bankrupt company.

No matter the metal, liquidity is crucial and essential, regardless of the type.

What to do, what to do.

Frankly, all gold/metals holdings have risks. But certain things can lessen the possible sting if it moves the wrong way or increases the profit if it rises in price.

As I mentioned, liquidity. Mercifully, I went over this concept above.

Owning promising, quality, junior or intermediate publicly traded metals shares, should be strongly considered. Many names are available for risk-oriented investors or those who like dealing with juniors. There are due diligence steps—or as close as possible, given these are juniors.

First, look at management. Many accountants who have pastureland 150 miles from a small mine next to a burned down church seem more like a tax shelter scheme than a gold company. Management should have the appropriate experience, geologically speaking, and a series of medium to significant successes in the career.

Second, avoid the ‘we’ve got equipment on the site’ or minimal 75-year-old chip results.

Third, look for companies with several provable commodities on their properties. Help to spread the risk and offer more profit opportunities. Critical/battery metals are an excellent addition if you are considering.

You know I have an example.

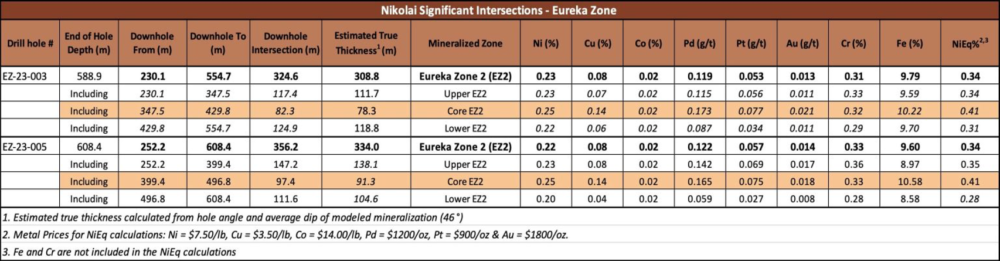

Alaska Energy Metals Corporation (TSX-V: AEMC, OTCQB: AKEMF) (“AEMC” or “the Company”) is focused on delineating and developing a sizeable polymetallic exploration target in Alaska containing Nickel, copper, cobalt, chrome, iron, platinum, palladium, and gold. Shares are up nicely

YTD, so diving in is likely worthwhile.

The Company has a 52-week hi lo of CDN0.17 to CDN0.67. Money has been made, and likely will be again.

While the Company’s properties are impressive, management is up to the task. These aren’t a bunch of Howe Street clowns—’ Hey, drill’s on property’—types. These are serious mining people with exceptional qualifications. Mix that fact with the qualities of the property, and most savvy investors would do well to take a serious look. Also, anyone involved in the E.V., battery space or in some or all of the commodities in The Nikolai– Nickel, copper, cobalt, platinum, palladium, and gold.

Only those investors paying minimal attention will realize that AEMC is not primarily a gold stock. As a matter of fact, Nickel is its primary metal. As I said before, any mining company has to show decent to excellent results to entice investors.

With AEMC—Corporate Presentation—many bases are covered, not the least of which are E.V./Critical Metals. The gold observations stand and serve as an example of what to look for in a junior miner.

The cogent trading of junior metals stocks, whether gold, cobalt, palladium, etc is paramount.

If juniors freak you out, buy Bell Canada.

Posted on Behalf of Alaska Energy