With the possibility of Donald Trump leading the United States once again, significant economic and environmental policies are poised for potential change. Trump’s transition team has already hinted at plans that could reshape various sectors, from the electric vehicle (EV) market to consumer goods. Here’s an in-depth look at some of the key policy proposals on the table and how they might affect both the economy and the average American household.

Ending the $7,500 EV Tax Credit

One of the most notable proposals from Trump’s transition team is the elimination of the $7,500 federal tax credit for electric vehicles. This credit has been instrumental in promoting EV adoption across the U.S. by making electric cars more affordable to the public. The end of this subsidy could have widespread implications, especially as the U.S. grapples with its transition to cleaner energy sources.

According to sources from Reuters, Trump’s energy-policy transition team, led by oil magnate Harold Hamm and North Dakota Governor Doug Burgum, is pushing to dismantle the credit. While electric vehicle giant Tesla, led by CEO Elon Musk, has expressed tepid support for this decision, other automakers like GM, Ford, and the Alliance for Automotive Innovation are against it. They argue that these credits are “critical to cementing the U.S. as a global leader in automotive technology.”

If eliminated, the EV market in the U.S. could face setbacks. Tesla, which currently leads the market, may manage to weather the impact. However, competitors such as GM and Ford could see a decrease in EV sales, making it harder for them to catch up in the rapidly evolving EV sector. With the subsidy removal, many legacy automakers fear that Tesla’s dominance may only grow stronger, especially as new players struggle without government support.

Proposed Tariffs and Consumer Cost Increases

Beyond the EV credit, Trump’s proposed tariffs on imports could bring widespread repercussions for the economy. During his campaign, Trump promised to impose tariffs ranging from 10% to 20% on all imports and up to 60% on Chinese goods. Economists warn that these tariffs could lead to a significant increase in consumer costs, impacting everything from clothing to household appliances.

Estimates from the Peterson Institute for International Economics (PIIE) suggest that Trump’s tariffs could cost American households an additional $2,600 per year. The Yale Budget Lab warns that the cost could reach as high as $7,600 per household, once ripple effects like retaliatory tariffs and reduced competitiveness are factored in. Kimberly Clausing, a senior fellow at PIIE, notes that “domestic goods typically don’t remain cheap after tariffs” and predicts that prices would increase to match the tariff rates.

Low-income households are expected to feel the brunt of these price hikes, particularly in areas like apparel. According to the National Retail Federation, low-income Americans spend a larger portion of their income on goods like clothing compared to wealthier families, making them disproportionately vulnerable to price hikes in these sectors.

Impacts on U.S. Manufacturing and Global Trade

Trump’s tariffs are also likely to disrupt U.S. manufacturing and trade relations. By increasing import costs, domestic manufacturers may initially benefit as consumers turn to American-made goods. However, industries heavily reliant on imported components could face higher production costs, reducing their competitive edge. This issue is further complicated by retaliatory tariffs from trading partners, which could make it more difficult for American companies to export goods affordably.

Clausing from PIIE projects that Trump’s proposed tariffs could cost the economy approximately 1.8% of GDP. This would be nearly five times greater than the tariffs introduced during Trump’s first term and could contribute to inflation. According to Karen Karniol-Tambour of Bridgewater Associates, these tariffs could add around 0.5% to inflation, a considerable increase in the current economic environment.

Economic Rationale and Industry Reactions

Trump’s team argues that eliminating EV tax credits and imposing tariffs are necessary to fund the extension of tax cuts. The Republican Congress is expected to pass a comprehensive tax-reform package, one of its first major moves if Trump assumes office. To achieve this, Trump’s team has identified cost-saving measures, including the removal of EV subsidies, as a means of offsetting the financial burden of continued tax cuts.

However, not everyone is on board. The Alliance for Automotive Innovation, a major automotive industry group, has urged Congress to retain the EV tax credits. They believe these incentives are essential for securing the U.S.’s competitive position in clean automotive technology. The Alliance’s October 15 letter argued that maintaining the credit is vital to making the U.S. a global leader in EV technology and manufacturing.

The Impact on Clean Energy Initiatives

Trump’s policies are expected to clash with President Biden’s clean energy initiatives, particularly the Inflation Reduction Act (IRA). While Biden’s administration focused on reducing carbon emissions and promoting renewable energy sources, Trump has repeatedly pledged to end what he describes as Biden’s “EV mandate” and boost oil production. With the planned rollback of green initiatives, the U.S. could see a shift away from renewable energy sources, at least temporarily.

Ending the EV tax credit could be the beginning of a broader rollback of clean energy incentives, with subsidies for wind, solar, and hydrogen production potentially facing similar fates. Hamm and other oil industry advocates within Trump’s transition team view these green subsidies as costly measures that disproportionately benefit emerging energy sectors at the expense of established industries like oil and gas.

What This Means for the Future

With Trump’s potential return to office, American consumers and industries could see sweeping changes. Higher costs for everyday goods, potential setbacks in the EV market, and increased oil production are all on the horizon if Trump’s proposed policies come into effect. For consumers, the anticipated price hikes on items like clothing, electronics, and cars could strain household budgets.

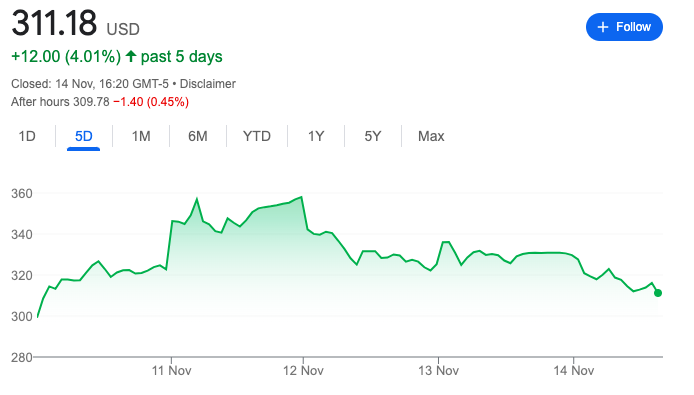

For investors, these changes signal shifts in key markets. Oil and gas companies may see a resurgence as renewable energy initiatives slow down. Meanwhile, Tesla could continue to dominate the EV market if subsidies end, with smaller competitors facing greater challenges in growing their market share.

Conclusion: A Return to Trump’s Vision for America

If Trump assumes office again, his administration’s policies may fundamentally alter the U.S. economic landscape. His stance on tariffs and energy subsidies signals a return to policies prioritizing American-made goods, oil production, and reduced dependence on clean energy subsidies. The decision to eliminate the EV tax credit could hinder the nation’s transition to sustainable transportation, while the proposed tariffs threaten to increase costs for consumers.

Ultimately, Trump’s leadership could bring a return to a more protectionist and oil-focused America. For now, businesses, consumers, and environmental advocates will be watching closely to see if Trump’s proposals come to fruition and reshape the U.S. economy once more.

Marc has been involved in the Stock Market Media Industry for the last +5 years. After obtaining a college degree in engineering in France, he moved to Canada, where he created Money,eh?, a personal finance website.