The Basics: What Are Interest Rates?

Let’s keep it simple. Interest rates are what you pay to borrow money, or what you earn when you lend it.

- Borrowing for a house? That rate on your mortgage is the interest rate.

- Tossing savings into a bank account? That tiny return? Also an interest rate.

Central banks — like the Bank of Canada — use interest rates to steer the economy. If inflation is too high, they hike rates to slow down spending. If things get too sluggish, they drop rates to make borrowing easier.

It sounds boring, but here’s the thing: interest rates affect almost every corner of your life.

As former BoC Governor Stephen Poloz once said: “Interest rates are like gravity for the economy — they affect everything, from borrowing to investment to job creation.”

And current BoC Governor Tiff Macklem emphasized in 2024: “We are not out of the woods yet. Inflation remains a concern, and our decisions on interest rates will reflect that reality.”

Why It Matters: The Real-World Ripple Effect

Let’s cut to it — here’s what happens in a high-interest rate world like we’re living in right now.

🏠 Your Mortgage or Rent

- Variable-rate mortgages are painful. A rate that was 1.5% in 2021 might be 5.5% today. That’s hundreds more per month — easily.

- Landlords with higher mortgage costs? They’re hiking rent too.

🚗 Buying a Car

- The days of 0% financing are gone. You’re looking at 6–9%, sometimes more.

- That extra 1–2% makes your monthly payment noticeably heavier.

💳 Credit Cards & Loans

- Most credit cards charge 19% or more. With rates up, people carrying balances are getting crushed.

- Personal loans? Student loans? Everything just costs more.

💼 Jobs and Small Business

- Higher rates = tighter credit. Small businesses can’t afford to expand.

- Slower hiring, fewer raises. It all trickles down.

💸 Your Investments and Savings

- GICs and savings accounts are finally giving you something back. That’s a small win.

- But stocks — especially tech and growth — are shaky. High rates usually hit those hardest.

Real Talk: Olivia’s Story

Olivia is 34, works full-time in Quebec, and just had her first baby.

- She bought a condo in 2021 with a $420K mortgage at 1.9%. It just jumped to 5.3%. That’s $700+ more per month.

- She’s carrying $8K in credit card debt. That’s $150+ a month in interest — just interest.

- She planned to upgrade her car but now can’t stomach the 10% loan offer.

She didn’t lose her job. She didn’t make bad decisions. But high rates are slowly suffocating her monthly budget.

This is how it hits: not all at once, but everywhere at once.

When the BoC Moves — What Actually Happens?

As of June 4, 2025, the Bank of Canada held its overnight rate at 2.75% — keeping things steady while inflation cools but remains above the 2% target.

Now let’s break it down with two scenarios:

📍 Scenario A: BoC Holds Rates

- Olivia’s variable mortgage rate stays around 5.3%. Her payments don’t rise, but they’re still high.

- Banks keep their prime lending rate at ~4.95%, which affects credit lines and personal loans.

- Fixed mortgage rates inch up slightly due to rising bond yields. A new 5-year fixed hits 5.24%.

- GICs still offer ~4.5%, but investors start bracing for volatility.

📉 Scenario B: BoC Cuts Rates by 0.25% in Fall 2025

- Prime rate drops to ~4.70%, lowering Olivia’s monthly mortgage payment by about $50.

- Her credit card APR may dip slightly — but only by ~0.25% unless the BoC cuts again.

- Fixed mortgage rates could soften, offering better options at renewal.

- Businesses see cheaper lines of credit, improving hiring outlooks.

- GICs and savings yields decline slightly — maybe to 3.85–4.1%.

- TSX and tech stocks could rally slightly on expectations of renewed growth.

This is how a single 0.25% change moves through housing, borrowing, savings, and job creation — even if you’re not watching the headlines.

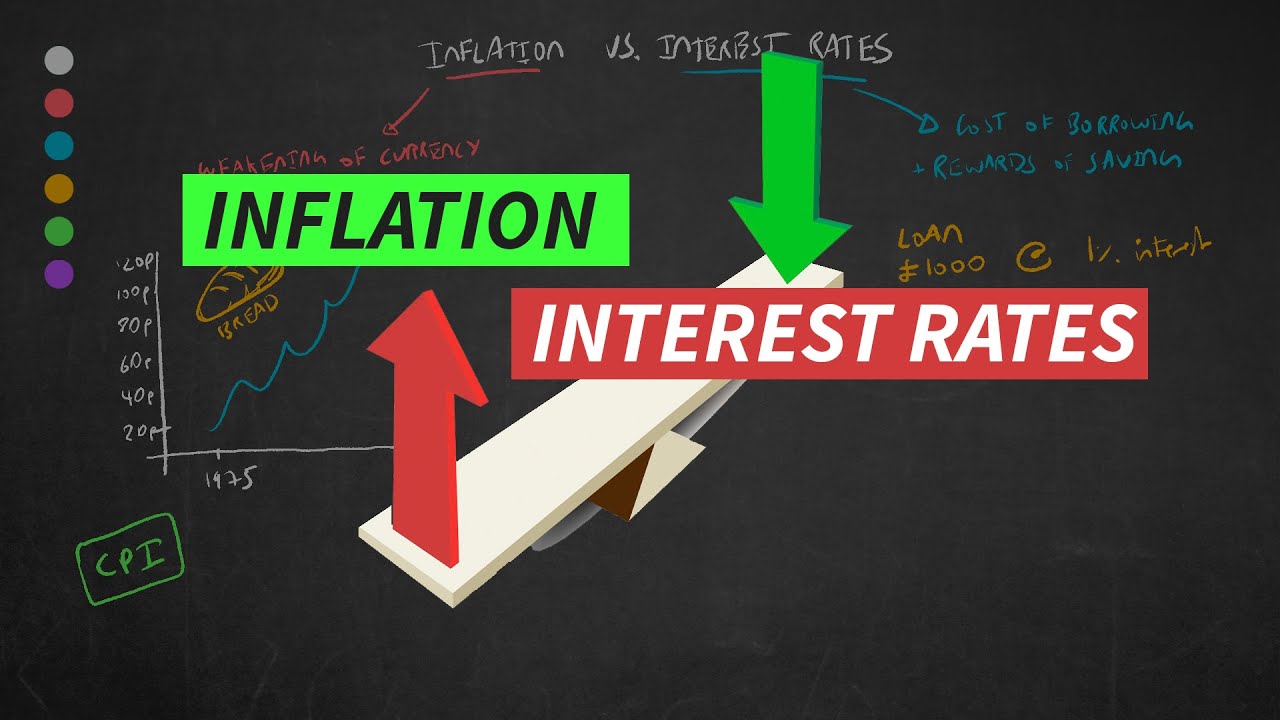

Why Rates Go Up (and Down)

Central banks raise rates to curb inflation — less spending = slower price hikes.

But the problem? Too many hikes = recession territory.

So when growth slows, they reverse course. Lower rates = cheaper loans = more spending and investment.

It’s a seesaw — and regular people are often stuck riding it blindfolded.

What Can You Actually Do?

Let’s be real. You can’t control the Bank of Canada. But you can:

- Refinance smart if you’re near mortgage renewal. Timing matters.

- Kill high-interest debt — especially credit cards. It’s dead weight.

- Stash an emergency fund — layoffs and slowdowns get more likely.

- Use high-interest savings accounts and GICs if you want peace of mind.

This isn’t about winning the game — it’s about not getting crushed while the rules keep changing.

TL;DR

- BoC held at 2.75% in June 2025.

- Olivia’s budget stays tight — but a rate cut later this year could ease pressure.

- When BoC moves, mortgage rates, car loans, job markets, and savings all move too.

- You can’t stop the rollercoaster — but you can strap in smarter.

Marc has been involved in the Stock Market Media Industry for the last +5 years. After obtaining a college degree in engineering in France, he moved to Canada, where he created Money,eh?, a personal finance website.