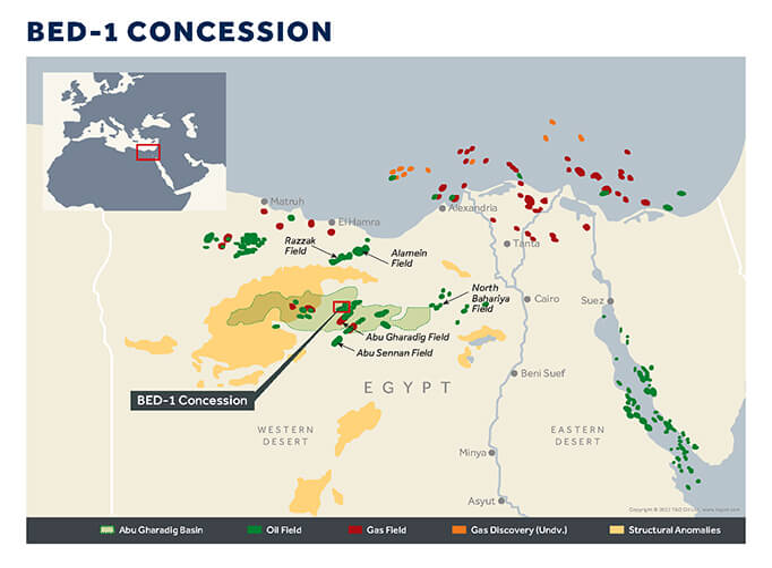

TAG Oil Ltd. (TSXV: TAO and OTCQX: TAOIF) (“TAG Oil” or the “Company“), based in Vancouver, BC, focuses on operations in the Badr Oil Field in the Western Desert of Egypt.

For investors who wish to acquire or add a high-quality international oil stock, TAO likely fits the bill. The quality and potential as a resource investment are worth investors’ close attention. Given the properties and business approach and the shares being a unique MENA (Middle East North Africa) play. The approach is more straightforward than investors might think at first blush.

Properties, Potential, People

TAG holds an interest in the Badr Oil Field (“BED-1”), a 26,000-acre concession located in the Western Desert, Egypt, through a Production Services Agreement (“PSA”) with Badr Petroleum Company (“BPCO”). Further, the Company is also entitled to a 2.5% royalty on gross revenue produced from the New Zealand assets previously sold and a 3.0% gross overriding royalty on potential future gas production from its former Australian assets. In New Zealand, the value of the royalty interest is attributable to the Company continuing to receive a gross overriding royalty equal to 2.5% of the gross sales revenue. In the 2022 calendar year, the Company received CDN$947,477 in royalty payments.” (Abby Badwi Executive Chairman)

MENA is the largest global oil reserve at 57% of oil and 41% of natural gas. OPEC Member Countries in MENA together have 840 billion barrels of proven crude oil reserves. They also have around 80 trillion cubic metres of proven gas reserves.

A well-placed junior could give quick exposure to the area. In case you were wondering t he largest oil country, I’ll save you going to the Google: Saudi Arabia with approximately 265 million barrels of oil. It produces 9k bpd and hopes to add offshore to raise that to12k bpd in the next few years.

Drill into Tag.

“While I believe in pursuing all sources of sustainable energy, oil and gas will continue to be a significant supplier of the energy mix for decades. MENA is a region with significant growth potential, and our team has the track record, expertise and unified vision to get the job done.” Abdel Badwi, TAG Executive Chairman.

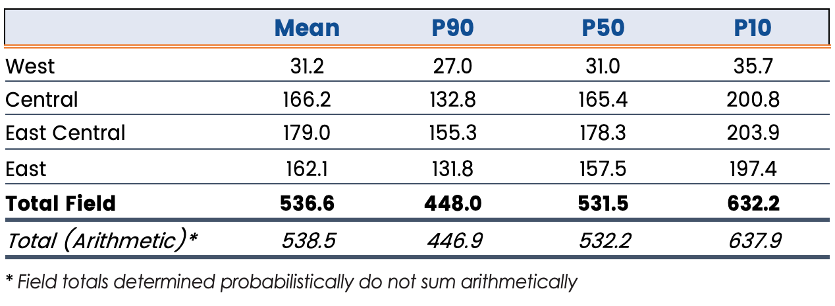

- Abu-Roash “F” formation (“ARF”) oil-initially-in-place P50 Volumes to be 531.5 million barrels over the Badr-1 (“BED-1”)

- focused on the east-central part of the BED-1 concession area and contains OIIP P50 Volumes of 178.3 million barrels and Mean Volumes of 179.0 million.

ARF OIL INITIALLY IN PLACE (“STOIIP”) VOLUMES (MMstb)

RATING & TARGET PRICE Price Target Market Cap ($M) Projected Return

SPECULATIVE BUY current C$0.58 projected C$1.25 Projected Return 115.5%

Market Cap C$104.70

TAG remains debt-free, and we estimate the Company has a current positive working capital of ~ $25mm.

(Bill Newman, CFA Research Capital)

The BC based company boasts over a century of combined management expertise, both national and international. Take a look. TAG recently concluded a large bought deal with proceeds of CDN12,253,394, which included an overallotment exercise with proceeds of CDN513,880.

Let’s conclude.

I avoid droning on about the minutiae of drilling, holes, etc. Here are the PRs if you are so inclined. My job is to delineate, not obfuscate.

- TAG has international oil exposure/proxy to the largest oil reserves in the world.

- No debt

- Highly experienced management

- Strategic drilling program

- Analyst projected price targets to CDN1.25 from CDN0.58 (return 115%)

- Any expansion of the Israel-Hamas war, depending on severity, could cause oil to rise to between USD100 a barrel and US157. The highest oil price on record was in July 2008, when Brent traded as high as $147.5 per barrel, according to data from LSEG.

For speculative resource buyers, the case seems—especially in the mid CDN0.50 cent range—to be worth at least following, but likely dollar cost average strategy.

Sponsored Post on Behalf of Tag Oil